TOKYO, Nov 04 (News On Japan) –

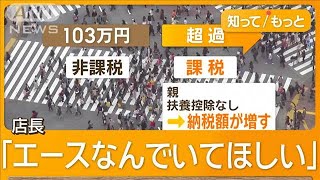

The ‘1.03 million yen income cap’ raised by Democratic Party for the People leader Tamaki has become a pressing issue for many students and part-time workers. How are they managing the realities of this policy?

The onset of end-of-year festivities has highlighted staffing issues at a busy Tokyo-based gyoza restaurant as employees face adjustments due to the earnings limit.

At “Gyoza Las Vegas Kitasenju,” known for its distinctive gyoza style, store manager Morita Masashi explained, “If they work too much, we’ll have to cut shifts at the end of the year.”

The 1.03 million yen income cap impacts the flexibility of part-time workers’ shifts.

Last month, Tamaki emphasized the urgency of raising this cap, stating, “It’s critical to increase the 1.03 million yen income threshold.”

Under current rules, exceeding 1.03 million yen results in income tax. For students, this can also mean the loss of dependent deductions for their parents, leading to higher tax bills and often limiting work hours.

Morita expressed his concern: “Our star worker really deserves to stay on, but…”

That star is university senior Inoda Riku, who, due to the limit, has cut his shifts to only four days this month.

“Now I’m making only 40,000 or 50,000 yen a month, less than half of peak earnings,” Inoda said. “I’ve had to dip into savings to make up the difference.”

Inoda wishes for the 1.03 million yen cap to be reconsidered so he can work freely. “I’d like to work without holding back; it feels like this would lift the restrictions,” he said.

But the issue isn’t limited to students.

A woman in Osaka with two high-school daughters facing college fees faces her own hurdles while working part-time under her husband’s health insurance.

“Prices are rising, but I have to keep within 1.03 million yen,” she explained. Her awareness of the limit heightened two years ago when her husband’s workplace pointed it out.

Though a special spouse deduction allows for income up to 1.5 million yen before taxes increase, some companies limit certain benefits to earnings below 1.03 million yen, and breaching 1.06 million or 1.3 million yen would trigger social insurance contributions.

The Democratic Party for the People continues to push for a change, even as the government warns that altering the threshold could reduce tax revenues by up to 8 trillion yen.

Chief Cabinet Secretary Hayashi stated last month, “It is true that the tax cuts would benefit higher-income earners more.”

Tamaki countered, “The increase in work opportunities from 1.03 million to 1.78 million yen would mostly benefit low-income earners, supporting those with lower incomes more.”

The government estimates a 7-8 trillion yen revenue loss from this adjustment, though Tamaki argued, “Consumers would have more in their wallets, which would fuel spending and corporate activity, likely increasing tax revenue.”

The “1.03 million yen cap,” established in 1995, may soon be subject to further negotiations between the Liberal Democratic, Komeito, and Democratic parties to discuss a potential reform.

Source: ANN