Ranked: Companies Acquiring the Most Startups

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Six of the 10 largest startup acquirers globally are based in Silicon Valley.

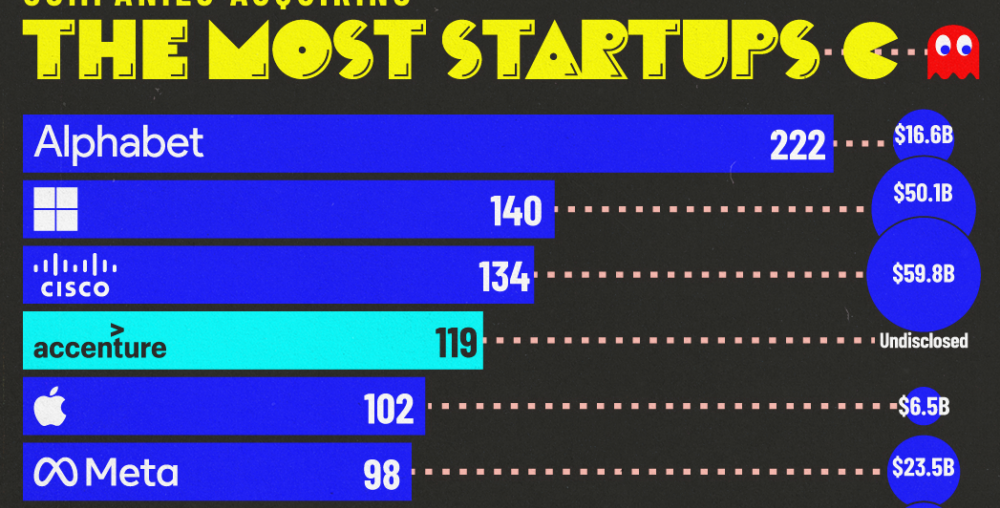

This visualization ranks companies by the number of startup acquisitions they’ve made, along with total deal values.

The data was compiled by Mind the Bridge with support from Crunchbase, covering 2,532 corporate-startup M&A transactions completed between 2000 and the first half of 2024, limited to Fortune Global 500 companies.

American Dominance

North American companies acquire startups at four times the rate of European firms, with an even larger gap compared to Asian companies, where North American firms acquire startups 7-10 times more frequently.

Alphabet (Google) leads the list with 222 acquisitions, followed by Microsoft and Cisco.

| Country | Company | Startup Acquisitions | Total Deal Value |

|---|---|---|---|

| 🇺🇸 USA | Alphabet | 222 | $16.6B |

| 🇺🇸 USA | Microsoft | 140 | $50.1B |

| 🇺🇸 USA | Cisco Systems | 134 | $59.8B |

| 🇮🇪 Ireland | Accenture | 119 | Undisclosed |

| 🇺🇸 USA | Apple | 102 | $6.5B |

| 🇺🇸 USA | Meta Platforms | 98 | $23.5B |

| 🇺🇸 USA | IBM | 93 | $21.5B |

| 🇺🇸 USA | Amazon | 76 | $10.7B |

| 🇺🇸 USA | Oracle | 76 | $7.6B |

| 🇺🇸 USA | Salesforce | 63 | $61.5B |

| 🇺🇸 USA | Intel | 57 | $4.9B |

| 🇩🇪 Germany | Siemens | 40 | $2.5B |

| 🇺🇸 USA | Qualcomm | 34 | $3.1B |

| 🇨🇭 Switzerland | Roche Group | 32 | $20.3B |

| 🇰🇷 South Korea | Samsung Electronics | 32 | $1B |

Siemens (Germany), Accenture (Ireland), Roche (Switzerland), and Samsung (South Korea) are the only non-American companies among the top 15.

Accenture is the only non-tech giant in the top 10.

Silicon Valley companies have completed 814 startup M&A deals, representing 33% of the total, accounting for roughly one-third of all startup acquisitions by Fortune Global 500 companies.

According to data from Mind the Bridge, startups are typically acquired 6 years after their founding (46%). Another 35% of target companies are between 6 and 10 years old, while less than 20% involve more mature companies.

Learn More on the Voronoi App

If you enjoyed this graphic, check out this graphic that shows how Google became the most valuable media brand.