Bill Gurley was one of Silicon Valley’s smartest and most successful VCs. He recently gave a talk at the All-In Summit that was really two talks in one. The first part was railing against the consequences of regulatory capture on innovation and a second part, about the consequences of premature government regulation of AI and why the incumbents are all for it. He illustrated his talk with regulatory horror stories in the telecom market, electronic health records, and Covid antigen tests.

Bill’s closing line, “The reason why Silicon Valley is so successful is that it’s so fxxxng far away from Washington” received great applause. Unfortunately, for startups entering a regulated market following this advice this might not be the optimum path.

(You can watch Bill’s entire 24-minute talk here or his thesis summarized in this 7 second clip here. https://youtu.be/HMIyDf3gBoY?feature=shared )

Let’s be clear, rent seekers and regulatory capture strangle innovation in its crib. It’s the antithesis of how founders want to build a business. (And to be fair that was the was the point of the last part of Bill’s presentation.) But entrepreneurs entering regulated markets need to understand how the game is played, how they can play it, what their VC’s should be doing to help them, and how to win.

Regulation

What’s regulatory capture? Why is it bad? And why was Bill’s advice of staying away from Washington flawed for startups?

All businesses have regulations to follow – paying taxes, incorporating the company, complying with financial reporting. And some have to ensure that there are no patents or blocking patents. But regulated markets are different. Regulated marketplaces have significant government regulation to promote and protect (ostensibly) the public interest for the benefit of all citizens. A good example is the regulations the FDA (Food and Drug Administration) have in place for approving new drugs and medical devices.

In a regulated market, the government controls how products and services are allowed to enter the market, what prices may be charged, what features the product/service must have, safety of the product, environmental regulations, labor laws, domestic/foreign content, etc. In the U.S. regulation happens on three levels:

- federal laws that are applicable across the country developed by Federal government in Washington, D.C.

- state laws that are applicable in one state imposed by state government

- local city and county laws come from local government

Federal Regulation

In the U.S. the government has regulatory authority over commerce between the states, foreign trade, and other business activities of national scope. Congress decides what things need to be regulated and passes laws that determine those regulations. Congress often does not include all the details needed to explain how an individual, business, state or local government, or others might follow the law. To make the laws work day-to-day, Congress authorizes government agencies to write the regulations which set the specific requirements about what is legal and what isn’t. The regulatory agencies then oversee these requirements.

In the U.S. startups might run into an alphabet soup of federal regulatory agencies, for example: ATF, CFPB,DEA, DoD, EPA, FAA, FCC, FDA, FDIC, FERC, FTC, OCC, OSHA, SEC. These agencies exist because Congress passed laws.

State Regulation

In addition to federal laws, each State has its own regulatory environment that applies to businesses operating within the state in areas such as land-use, zoning, motor vehicles, state banking, building codes, public utilities, drug laws, etc.

Cities/County Regulation

Finally, local cities and counties may have local laws and regulatory agencies or departments like taxi commissions, zoning laws, public safety, permitting, building codes, sanitation, drug laws, etc.

Incumbents Advantage – Rent Seekers and Regulatory Capture

If you’re a startup entering a regulated market (Telecom, Pharma, Education, Energy, Department of Defense, Intelligence, Health, Fintech, Insurance, Transportation, Agriculture, Gaming, Cannabis, Petrochemicals, Automotive, Air Transportation, Fishing, et al.) you need to know that the game is rigged. And it’s not in your favor.

Incumbents in a regulated a market keep out new, innovative, and disruptive competitors by “gaming the system” in their favor. They do this by either being Rent Seekers and/or by Regulatory Capture. (Bill Gurley’s point.)

Rent seekers are individuals or organizations with successful existing business models who use government regulation and lawsuits to keep out new entrants that might threaten their business models. They use every argument – from public safety to lack of quality or loss of jobs – to lobby against the new entrants. Rent seekers spend money lobbying to increase their share of an existing market instead of creating new products or markets but create nothing of value.

These barriers to new innovative startups are called economic rent. Examples of economic rent include state automobile franchise laws, taxi medallion laws, limits on charter schools, cable company monopolies, patent trolls, bribery of government officials, corruption, and regulatory capture.

Rent-seeking lobbyists go directly to legislative bodies (Congress, State Legislatures, City Councils) to persuade government officials and their staff to enact laws and regulations in exchange for campaign contributions, appeasing influential voting blocks, or the “revolving door” – offering officials future jobs in the industry they regulated. They use the courts to tie up and exhaust a startup’s limited financial resources. Their lobbyists also work through regulatory bodies like the FCC, SEC, FTC, Public Utility, Taxi, or Insurance Commissions, School Boards, etc.

Regulatory capture is what happens when the very organizations set up to protect the public’s health and safety, or to provide an equal playing field, are taken over by the very people they’re supposed to regulate. These are the examples Bill Gurley were talking about.

Tech Companies Use Regulatory Capture

In my first two decades inside the Silicon Valley bubble we built products people wanted and needed. We competed with other technology companies, and, like Bill Gurley, largely ignored whatever was going on in Washington. We were content Washington didn’t know we existed. Unless you were in life sciences (therapeutics, medical devices, or diagnostics), very little government regulation applied. We ignored Washington and Washington mostly ignored us (defense contractors excepted.)

The tech ecosystem got a rude awakening in May 1998 when the U.S. Justice Department and 20 state Attorneys General brought suit again Microsoft for anticompetitive practices designed to maintain its monopoly in PC operating systems and internet browsers. While tech hadn’t come to Washington, Washington came for the tech industry. Until then no tech company had an organized lobbying organization of significance in DC.

Fast forward 25 years. The tech industry grew up and realized rather than running away from Washington they needed to play the game. Companies like Intuit mastered regulatory capture as a massive advantage while Big Tech (Microsoft, Amazon, Google, Facebook, Oracle, Intuit, Uber et al.) spent $124 million in lobbying and campaign contributions in the 2020 election with 333 registered lobbyists.

Startups have successfully disrupted regulated markets and rent seekers – Uber with local taxi licensing laws (a board Bill Gurley sat on with a ShowTime series highlighting his role), AirBnB with local zoning laws, Tesla with state dealership licensing, SpaceX competing with the Air Force and United Launch Alliance – and in doing so they have built impenetrable moats for their business.

What Do Startups Need to Know?

There’s nothing magical about dealing with regulated markets. However, every regulated market has its own rules, dynamics, language, players, politics, etc. And they are all very different from the business-to-consumer or business-to-business markets most founders and their investors are familiar with.

How do you know you’re in a regulated market? It’s simple– ask yourself three questions:

- Can I do anything I want or are there laws and regulations that might stop me or slow me down?

- Are there incumbents who will view us as a threat to the status quo? Can they use laws and regulations to impede our growth?

- Do you understand how the regulatory process works? For example, do you just fill out an online form and pay a $50 fee with your credit card and get a permit? Or do you need to spend millions of dollars and years running clinical trials to get FDA clearance and approval? And are these approvals good in every state? In every country? What do you need to do to sell worldwide?

What Do I Need to Do?

The first step is to understand what you’re up against. Who are the incumbents, who do they influence, how much are they spending on influence, who are their lobbyists, and what are their messages? And most importantly, how are they going to stop you from scaling?

Next, figure who are the other stakeholders, saboteurs, rent seekers, influencers, bureaucrats, politicians, and regulators. As you get out of the building and start talking to people you’ll discover more and more players. You’ll discover that the interests of your product’s end user versus a regulator versus an advocacy group, key opinion leaders or a politician, are radically different. For you to succeed you need to understand all of them.

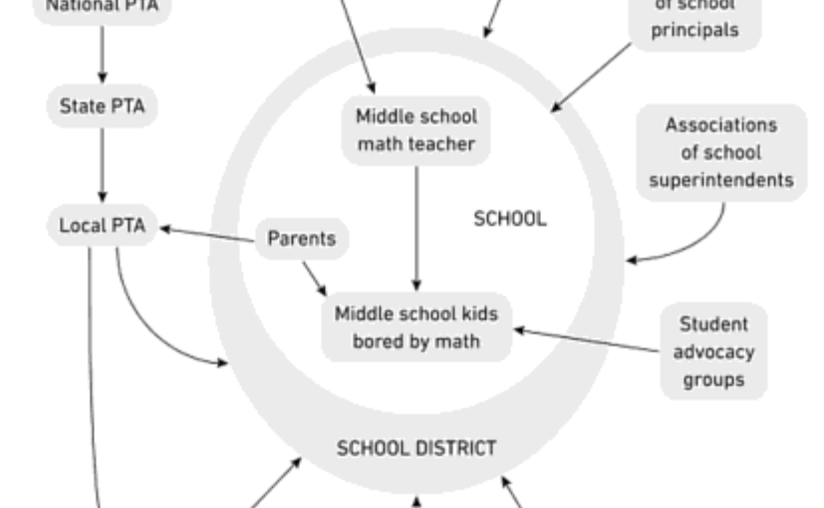

Start diagraming out the relationships of all the customer segments. Who influences who? How do they interconnect? What laws and regulations are in your way for deployment and scale? How powerful are each of the players? For the politicians, what are their public positions versus actual votes and performance. Follow the money by using opensecrets.org. If an elected official’s major donor is organization x, you’re not going to be able to convince them with a cogent argument. And most importantly, start asking “who are the best lobbyists/advisors in this market?”

The book Regulatory Hacking calls this diagram the Power Map. As an example, this is a diagram of the multiple beneficiaries and stakeholders that a software company developing math software for middle school students has to navigate. Your diagram may be more complex. There is no possible way you can draw this on day one of your startup. You’ll discover these players as you get out of the building and start filling out your value proposition canvases.

While this sounds complicated, entering a regulated market should be a strategy not a disconnected set of tactics. (Or worse obliviousness.) You need a lobbying/government relations strategy from day one.

Draw your strategy diagram (see figure below) and share it with your board. What regulatory issues need to be solved? In what order? For example, do you beg for forgiveness or ask for permission? How do you get regulators who don’t see a need to change to move? How do you get your early customers to advocate on your behalf? (The books The Fixer and Regulatory Hacking give examples of regulatory pitfalls, problems and suggested solutions.)

Most early stage startups don’t have the regulatory domain expertise in-house. Get outside advice at each step. Hire/advisors from the inside industry but use them to make you smarter not just to outsource the work. Having a meeting or two with a congressman or contributing to their campaign might get you a return call, but only sustained engagement (via money, influence, and an on-the-ground presence in D.C.) will move the needle. Eventually you’ll need to build an in-house team to manage regulatory affairs.

Most early stage startups don’t have the regulatory domain expertise in-house. Get outside advice at each step. Hire/advisors from the inside industry but use them to make you smarter not just to outsource the work. Having a meeting or two with a congressman or contributing to their campaign might get you a return call, but only sustained engagement (via money, influence, and an on-the-ground presence in D.C.) will move the needle. Eventually you’ll need to build an in-house team to manage regulatory affairs.

Choose VCs who have experience in operating in regulated markets – not those who hope it stays away. Have them tell you how they helped other companies in their portfolio succeed, pitfalls to avoid, and the lobbying resources they can bring to bear. You and your board need to be in sync about the costs and risks of getting into a street fight entering these markets. (Strategic choices include asking for permission versus forgiveness, public versus private battles. Tactical activities can include influencing key opinion leaders, political donations, advocacy groups, and grassroots and grasstops campaigns, etc.)

Finally, as an innovation ecosystem (VCs, their limited partners, and startups) we need to do a better job in insisting in transparency in government, calling out rent seekers and regulators who no longer regulate, and try to keep government from premature regulation of new innovation. For the majority of regulators and policymakers who want to make the system better, we can help shape policy by educating them on why the products/changes we are proposing make the world a better place.

But startups? They need to understand the game and work the system.

Post note. Ironically the best example of premature government regulation was AT&T and U.S. telephone service. In 1921 AT&T argued that telephone service was a natural monopoly, and that competition was inefficient. The government agreed and land line communications became a government sanctioned monopoly for the next 63 years. Innovation in telecom outside of AT&T died and the industry could only innovate as fast as AT&T approved. A possible proxy for why the incumbent AI providers went to Congress. They want to lock-in their lead.

Lessons Learned

- If you’re in regulated market, often the game is rigged by incumbents

- Understand Rent Seeking and Regulatory Capture

- You need a lobbying/government relations strategy from day one

- Choose VCs who understand how to play the game not those who hope it stays away

- The CEO needs to get out of the building to understand the regulatory ecosystem

- CEO and board need to be in sync about the learning and strategy

- Hire initial lobbyists (but learn from them, not just outsource to them)

- As the company gets larger staff an internal public affairs group to manage the lobbying effort

- If you figure out the regulatory game, it can be your defensible moat

Filed under: Corporate/Gov’t Innovation |