Top Personal Income Tax Rates of European Countries

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Income tax rates in Europe vary widely and reflect different approaches to funding public services, with countries imposing higher top marginal tax rates often supporting extensive social welfare systems, while those with lower rates may prioritize competitiveness or maintain less comprehensive programs.

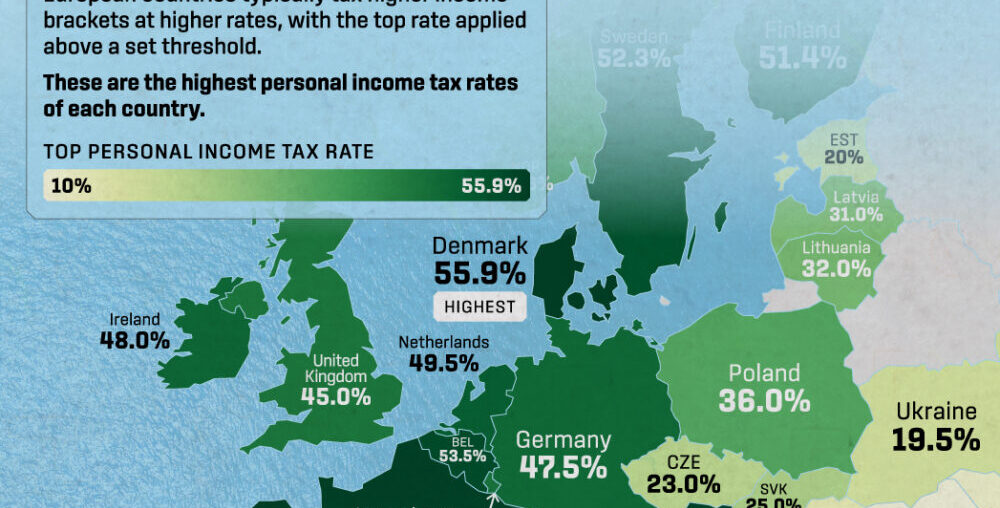

This map shows the top statutory personal income tax rate of 36 European countries.

European countries typically use a progressive tax system, where higher income brackets are taxed at higher rates, with the top rate applying only to income above a set threshold. These are the highest personal income tax rates of each European country.

The data comes from the European Commission and PwC via Tax Foundation (updated as of February 2024), with combined central and sub-central top personal income tax rates and surtaxes shown. Social security contributions are not included.

Which European Countries Tax Top Earners Most?

Below, we show the top statutory personal income tax rate for 36 major European countries.

| Country | Top Statutory Personal Income Tax Rate |

|---|---|

| 🇦🇹 Austria | 55.0% |

| 🇧🇪 Belgium | 53.5% |

| 🇧🇬 Bulgaria | 10.0% |

| 🇭🇷 Croatia | 35.4% |

| 🇨🇾 Cyprus | 35.0% |

| 🇨🇿 Czech Republic | 23.0% |

| 🇩🇰 Denmark | 55.9% |

| 🇪🇪 Estonia | 20.0% |

| 🇫🇮 Finland | 51.4% |

| 🇫🇷 France | 55.4% |

| 🇬🇪 Georgia | 20.0% |

| 🇩🇪 Germany | 47.5% |

| 🇬🇷 Greece | 44.0% |

| 🇭🇺 Hungary | 15.0% |

| 🇮🇸 Iceland | 46.3% |

| 🇮🇪 Ireland | 48.0% |

| 🇮🇹 Italy | 47.3% |

| 🇱🇻 Latvia | 31.0% |

| 🇱🇹 Lithuania | 32.0% |

| 🇱🇺 Luxembourg | 45.8% |

| 🇲🇹 Malta | 35.0% |

| 🇲🇩 Moldova | 12.0% |

| 🇳🇱 Netherlands | 49.5% |

| 🇳🇴 Norway | 39.6% |

| 🇵🇱 Poland | 36.0% |

| 🇵🇹 Portugal | 53.0% |

| 🇷🇴 Romania | 10.0% |

| 🇸🇰 Slovakia | 25.0% |

| 🇸🇮 Slovenia | 50.0% |

| 🇪🇸 Spain | 54.0% |

| 🇸🇪 Sweden | 52.3% |

| 🇨🇭 Switzerland | 39.5% |

| 🇹🇷 Turkey | 40.8% |

| 🇺🇦 Ukraine | 19.5% |

| 🇬🇧 United Kingdom | 45.0% |

Among European OECD countries, the average top statutory personal income tax rate is 42.8%.

Denmark (55.9%), France (55.4%), and Austria (55%) have the highest rates, while Hungary (15%), Estonia (20%), and the Czech Republic (23%) have the lowest.

Generally, European countries outside the OECD have lower top tax rates and often use a flat tax system. Bulgaria and Romania have the lowest rate at 10%, followed by Moldova (12%), Ukraine (19.5%), and Georgia (20%).

Scandinavian countries, recognized for their extensive social safety nets and public funding for services like universal healthcare, higher education, and parental leave, also impose relatively high personal income tax rates.

Denmark is making substantial changes to its personal income tax system that will take effect in 2026, which may impact the country’s top earners significantly.

Under the new three-tier tax structure, high-income earners in Denmark making over DKK 2,588,300 may face a total marginal tax rate of up to 60.5%. Denmark ranks sixth in the world for countries with the highest wealth per person in both average and median wealth measurements.

Learn more on the Voronoi App

To learn more about taxation across various countries, check out this graphic that visualizes major economies’ tax-to-GDP ratios.