In the early days of financial planning, serving clients often meant developing transactional relationships focused on facilitating trades and selling insurance. Over time, advisors shifted toward more analytical approaches, such as investment management and retirement planning. Today, the industry has evolved further, with a growing emphasis on aligning financial decisions with clients’ personal priorities and life goals. While this shift from numbers-based strategies to a more holistic, values-driven framework has opened the door to deeper, more meaningful conversations, it also presents a challenge for clients who may struggle to define their values or articulate a sense of purpose.

In this article, Jeremy Walter, founder of Fident Financial, and Andy Baxley, founder of Two Trails Financial Planning, discuss how advisors can follow a 3-part framework to help clients craft an informative, values-based statement of financial purpose.

The process begins by helping clients define their core values. This can involve asking reflective questions, such as “What does a perfect day look like to you?” or “How do you define success, security, and a life well-lived?” These questions encourage clients to uncover important themes – such as business growth, building a legacy, or prioritizing simplicity and family time – that guide their decisions. Typically, these values fall into 2 categories: realized values, which are already present in a client’s life, and aspirational values, which represent qualities they want to embody. Advisors can then ask follow-up questions to further explore and deepen these themes, helping clients gain even greater clarity.

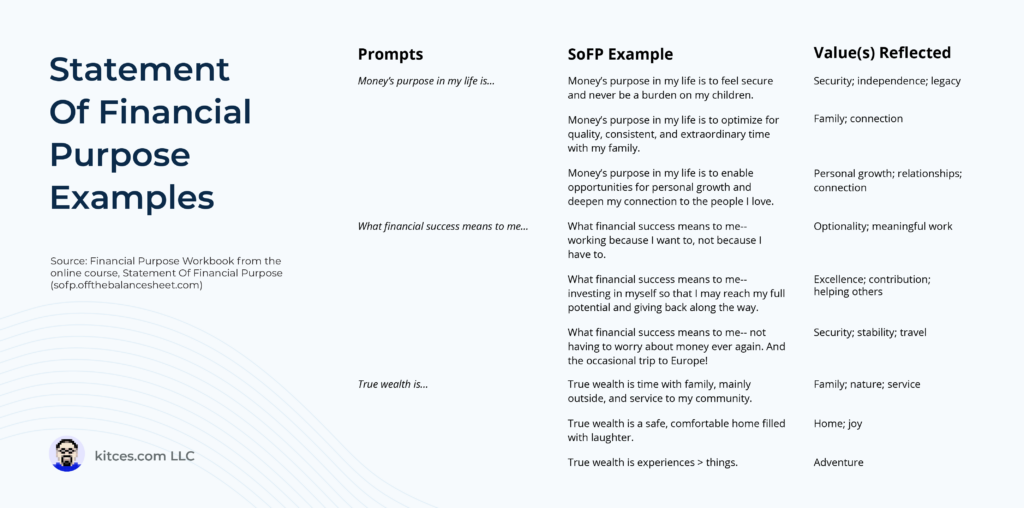

Once the client’s values have been established, the next step is to articulate a statement of financial purpose – a concise expression that captures the “why” behind the client’s financial decisions. This statement should go beyond superficial goals or what the client believes they should say, instead reflecting their true, deeply held priorities. Advisors play a crucial role here by helping clients draft, refine, and finalize a statement that feels authentic and actionable. This statement of financial purpose serves as an anchor for the client, providing clarity and direction as they make future financial decisions.

After the statement of financial purpose is created, the focus shifts to taking action. Advisors can help clients use their statement as a guide for assessing financial goals – both existing and future ones. Clients can reflect on whether their current goals are helping them get closer to living out their values or whether they need to revise their plan to better reflect what truly matters. The statement can also be used to establish new goals, ranging from more immediate, short-term objectives to larger, more ambitious stretch goals that, while challenging, may ultimately be more fulfilling. As clients begin to articulate and live by their values, advisors can revisit the statement periodically to ensure it remains relevant and aligned with evolving goals, and to assess whether adjustments are needed to better reflect their client’s reality.

Ultimately, the key point is that understanding a client’s values and purpose can unlock deeper, more meaningful financial planning conversations, enabling more fulfilling client discussions and allowing clients to do more with their money. And by aligning financial decisions with a clear statement of purpose, clients can foster a more intentional and meaningful relationship with their wealth!