Staff reporter

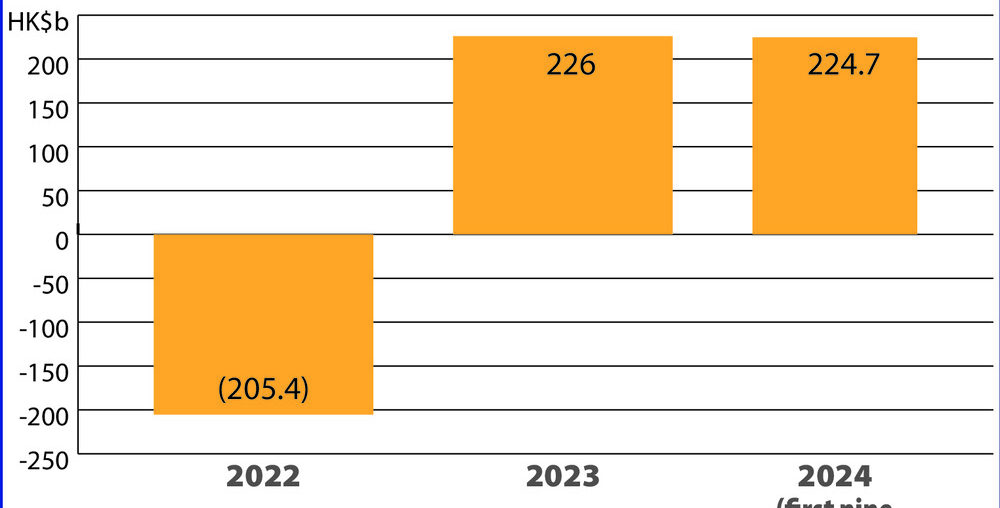

The Exchange Fund recorded an investment income of HK$114.6 billion in the third quarter, bringing the total for the first three quarters to HK$224.7 billion, the Hong Kong Monetary Authority announced at the Legislative Council Panel on Financial Affairs meeting.

That almost matches the HK$226 billion earned in all of 2023.

Third-quarter bond investment income doubled from the previous quarter to HK$66.4 billion. Hong Kong stock investments brought in HK$21.9 billion, up 1.5 times quarter-on-quarter, while other stock investments gained HK$18.2 billion, a 58 percent increase from the second quarter.

Non-Hong Kong dollar assets reversed earlier losses to achieve a revaluation gain of HK$8.1 billion.

HKMA deputy chief executive Howard Lee Tat-chi said lower bond yields in the third quarter lifted the value of bonds held by the Exchange Fund, while increased interest income from a year of rate hikes by major central banks and rapid gains in the Hong Kong and mainland stock markets in September enhanced the Fund’s overall investment returns.

Bond income in the first three quarters of this year reached HK$124.3 billion, Hong Kong stock earnings totaled HK$28.5 billion, other stock gains amounted to HK$66 billion, non-Hong Kong dollar assets saw a foreign exchange revaluation loss of HK$8.2 billion and other investment income was HK$14.1 billion.

Lee hopes to maintain positive growth in the final quarter but cautions that there are several political and macroeconomic factors to consider, urging not to focus too much on short-term investment performance.

HKMA chief executive Eddie Yue Wai-man said there will be many uncertainties in the coming two months, including US interest rate trends, the presidential election, geopolitical conflicts in Ukraine and the Middle East and China’s economic stimulus strategy.

The US Federal Reserve is expected to continue cutting rates, which could allow Hong Kong rates to ease under the pegged system, though short-term Hong Kong interbank rates will still be influenced by seasonal and market factors, Yue highlighted.

In other news, the introduction of a renminbi counter for the Southbound Scheme has been approved and the Mainland is working with Hong Kong Exchange and Clearing (0388) on technical integration, which will take some time, Yue said.

The Middle East offers huge business opportunities and authorities are actively engaging with the region, focusing primarily on central banks and sovereign funds, with follow-up visits planned from the central banks of Saudi Arabia and the United Arab Emirates, Yue added.