Esquire Knit Composite shares jumped by 22.08 per cent on Sunday as the company declared a 10 per cent cash dividend only for its general shareholders for the last fiscal year 2023-24.

The publicly traded company’s Board of Directors has recommended a 10 per cent cash dividend only for general shareholders, except sponsors and directors, for the year ended June 30, 2024.

The sponsors and directors hold 6.33 crore shares out of the total 13.48 crore shares of the company, and the cash dividend payable to the general shareholders is Tk 7.15 crore.

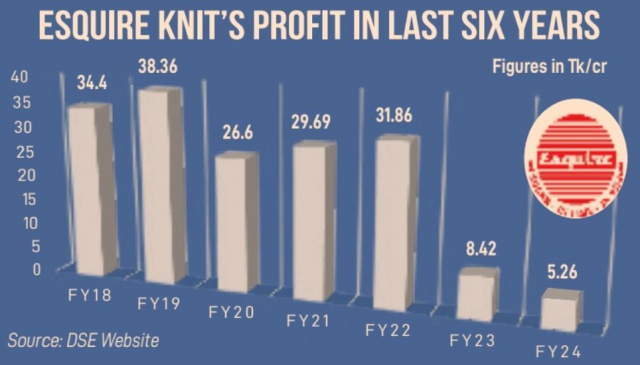

In the session, the company’s share price surged by Tk 3.4 to close at Tk 18.80 at the Dhaka Stock Exchange (DSE). The company has also reported consolidated earnings per share (EPS) of Tk0.39 for the year ended June 30, 2024, as against Tk 0.62 for the same period of the last year.

Its consolidated net asset value (NAV) per share of Tk 65.17, with revaluation reserve and consolidated NOCFPS of Tk -9.46 for the year ended June 30, 2024.

The Esquire Knit Composite board of directors has approved an investment of Tk 5 crore in L’Esquire Ltd – a subsidiary of the company – in a bid to better handle upcoming export opportunities.

This investment will be financed by withdrawing Tk 5 crore from Impress Capital Ltd – another associate company. Esquire Knit Composite had previously invested Tk 10 crore in Impress Capital Ltd.

Previously, Esquire Knit Composite invested in L’Esquire Ltd by leveraging investments from two of its associates.

On June 22, 2022, information published on the DSE website stated that Esquire Knit Composite Ltd invested Tk 4.77 crore in its subsidiary company, L’Esquire Ltd.

This investment would be financed on the basis of the withdrawal of equivalent capital invested in its two associate companies, where Esquire Electronics Ltd had Tk 3.75 crore and Esquire Accessories Ltd had Tk 1.02 crore.

On January 5 last year, Esquire Knit Composite decided to issue preference shares in a bid to finance expansion projects and machinery procurement. The company planned to raise a Tk 100 crore fund by issuing 10 crore preference shares at Tk 10 each, according to a DSE filing.

Out of the fund to be raised, the company would spend Tk 65 crore to finance its expansion projects and machinery procurement, while the remaining Tk 35 crore would be utilized to repay bank borrowings.

Preference shares are company shares against which investors avail no voting right and enjoy preference over the general shareholders to avail dividends in a regular situation as well as the leftover during liquidation.

The company’s preference shares would be issued for eight-year tenure, and in nature they would be fully redeemable, non-convertible, cumulative preference shares. Its dividend payment system would be paid semi-annually.

Currently, the Esquire Knit Composite has a reserve and surplus of Tk 637.39 crore while its paid-up capital is Tk 134.89 crore. The company has a short-term loan of Tk 394.12 crore and a long-term loan of Tk 199 crore.

Located at Sonargaon in Narayanganj, Esquire Knit has been emerging as a conglomerate with knitting, fabric dyeing, and finishing facilities under one roof since its commercial launch in 2001.

Esquire Knit Composite, which produces different types of knit garments and sells them to foreign buyers, raised Tk150 crore from the capital market in 2019.

From July to December 2023, its net loss was Tk 14.83 crore, which was Tk 6.87 core one year ago. During the period, its earnings per share were negative Tk 1.10 and its net asset value per share was Tk 64.20 with revaluation.

Sponsors and directors jointly hold 46.95 per cent of the company’s shares, while institutions and general investors own 40.92 per cent and 12.13 per cent, respectively.

Babu Kamruzzaman, an economic analyst and journalist, told the Business Post, “If the market index keeps falling like this, it will further erode investors’ confidence.

“Many of us expected a positive shift in the market in light of recent changes, and people had high hopes. But now, it feels as though the market is lacking proper oversight.”

He continued, “In my view, the Investment Corporation of Bangladesh (ICB) should quickly use the funds expected from Bangladesh Bank to support the market. Also, institutional investors should step in, particularly for stocks currently priced far below their actual value.”