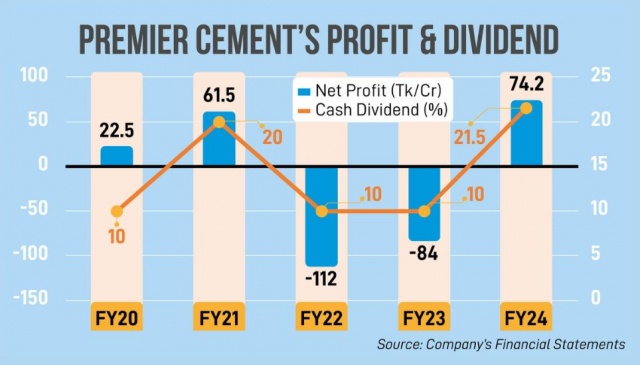

Premier Cement Mills PLC has bounced back to profitability, posting a Tk 74.23 crore profit for the financial year 2023-24 after enduring two consecutive years of losses.

The country’s leading cement manufacturer, which faced a Tk 84.23 crore loss in the previous year and Tk 112.83 crore in 2021-22, also announced a 21.50 per cent cash dividend—its highest in nine years.

The publicly traded company has set the annual general meeting (AGM) for November 30, with November 7 as the record date for dividend entitlement.

Premier Cement reported consolidated earnings per share (EPS) of Tk 7.04 for the financial year 2023-24, a significant turnaround from a loss per share of Tk 7.99 the previous year, according to a disclosure on the Dhaka Stock Exchange (DSE).

A company official attributed the recovery to reduced foreign exchange losses and the start of operations at a new, more efficient production unit.

The new plant, equipped with cutting-edge Vertical Roller Mill (VRM) technology, has enabled Premier Cement to produce high-quality cement at lower costs, improving its competitiveness in an increasingly challenging market. VRM technology not only enhances production efficiency but also optimises space utilisation, making it ideal for cost-conscious manufacturers.

Premier Cement’s consolidated net asset value per share rose to Tk 65.37, with consolidated net operating cash flow per share improving to Tk 6.27, up from Tk 59.33 and Tk 5.84, respectively, in the previous year.

This financial strength highlights the company’s improved performance and strategic advantages in the market.

Premier Cement Mills suffered a loss of Tk 112.83 crore in the financial year that ended on June 30, 2022. This reversed the Tk 65.17 crore profit the cement manufacturer made in the previous financial year of 2020-21.

The board of directors of Premier Cement Mills has paid a 10 per cent cash dividend for FY22. The company posted an 11 per cent year-on-year decline in profit to Tk 27.2 crore in the third quarter of 2023-24 despite a significant increase in sales.

It was Tk 30.79 crore in the January-March quarter of 2022-23. The company’s revenue for Q3 was Tk 753.23 crore, an increase of 25 per cent from Tk 601.49 crore in the same period of FY23, according to the unaudited financial statement.

Despite the decline in profit, the company’s net operating cash flow per share increased to Tk 0.5 from Tk 0.26. The net asset value per share was Tk 63.52 on March 31 this year, against Tk 59.33 on June 30 last year.

Shares of the company were up 4.52 per cent to Tk 61.80 on Monday at the Dhaka bourse.