Diminishing forecasts for future oil consumption are adding pressure to crude prices. This year’s Atlantic hurricane season has spun out fewer storms than 2023, but the toll from five that made landfall in the US will go down as some of the most destructive in recent memory. Orange juice futures are lingering at elevated levels.

Article content

(Bloomberg) — Diminishing forecasts for future oil consumption are adding pressure to crude prices. This year’s Atlantic hurricane season has spun out fewer storms than 2023, but the toll from five that made landfall in the US will go down as some of the most destructive in recent memory. Orange juice futures are lingering at elevated levels.

Here are five notable charts to consider in global commodity markets as the week gets underway.

Advertisement 2

Article content

Oil

Forecasts for oil consumption next year from three main forecasting groups have taken a bearish turn since July, largely driven by weakness in China. Those pared down projections have added a layer of gloom over the market that helped overshadow the ongoing turmoil in the Middle East. The International Energy Agency continued the trend last week, cutting its forecast further, with its estimate of a persistent glut next year contributing to crude’s sizable decline for the week.

Hurricanes

This year’s Atlantic hurricane season has logged 15 named storms so far, thanks to the emergence of Tropical Storm Nadine and Hurricane Oscar on the weekend. That’s approaching an average year, though the numbers can be deceiving: With five hurricane strikes on mainland US — including Helene and Milton that hit two weeks apart and devastated swaths of the South — may leave 2024 as one of the costliest storm seasons. The true scope of damages could take months to fully evaluate, but for context Katrina in 2005 caused $200 billion in inflation-adjusted damages and Harvey in 2017 racked up $160 billion in costs.

Article content

Advertisement 3

Article content

Orange Juice

Orange juice prices are about 50% this year as drought and disease undermine output from Brazil, the world’s biggest supplier of the juice, while Florida’s citrus groves continue to dwindle. Futures reached fresh records last month, and Hurricane Milton has underpinned higher prices after the storm felled fruits and trees in the top juice-producing US state. The US Department of Agriculture had already expected Florida’s production this season to be the lowest since 1933 — but adding Milton’s impact could deal an even bigger blow to the harvest.

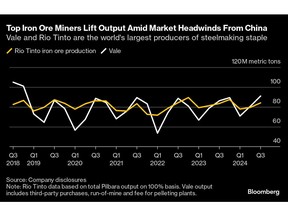

Iron Ore

The world’s two biggest suppliers of iron ore, Rio Tinto Group and Vale SA, boosted output of the steelmaking ingredient in the third quarter, even as demand from China faces headwinds due to the nation’s unresolved property crisis. Rio’s quarterly output has climbed from earlier this year, while Brazil’s Vale churned out its highest volume since late 2018, ahead of a dam-collapse disaster that triggered yearslong disruptions. The world’s top iron ore miners continue to beef up supplies, with their large-scale operations safeguarded by per-ton costs that remain far below current spot levels.

Advertisement 4

Article content

Electricity

The world is heading into an era of cheaper energy prices as a shift toward electricity use leaves behind surpluses of oil and gas, the International Energy Agency predicted. Electricity use has grown at twice the pace of total energy demand over the past decade, and is set to accelerate with global demand for all fossil fuels wanes, the IEA forecast in its annual long-term report. The agency expects global electricity generation to nearly double by 2050, with China leading growth in the Asia Pacific.

—With assistance from Brian K. Sullivan, Ilena Peng, Mariana Durao, Doug Alexander and Kevin Orland.

Article content

Comments