Are you tracking the right CRM KPIs? In a sea of data, it’s easy to drown in numbers that look impressive in your CRM software but offer little real insight. The key is to focus on KPIs that matter and provide actionable intelligence.

Here, we discuss how to separate the wheat from the chaff, explore CRM metrics that top-performing companies swear by and debunk some common myths.

Compare Top CRM Software Leaders

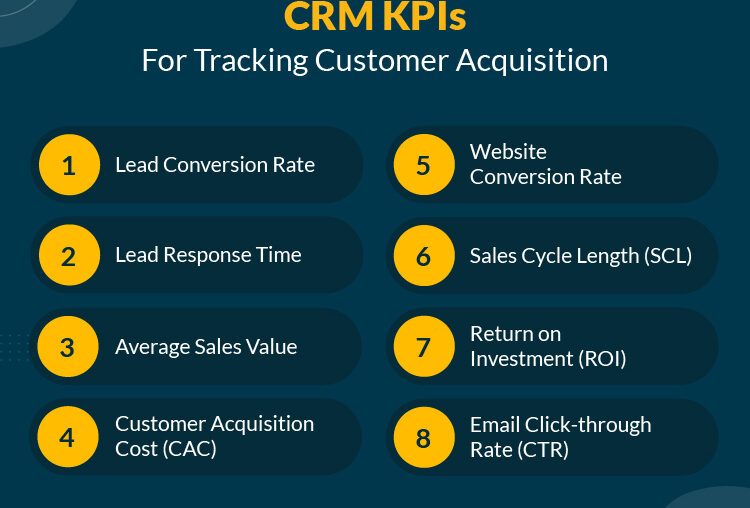

8 CRM KPIs to Track Customer Acquisition

When it comes to growing your business, customer acquisition is the fuel for the game. But how do you know if your efforts are paying off?

Customer acquisition KPIs are powerful metrics that act as your business’s radar, helping you spot new customers and measure the effectiveness of your strategies. By tracking the right KPIs, you can understand how well you’re attracting new customers, how much it’s costing you and whether your acquisition methods are sustainable.

1. Lead Conversion Rate

The lead conversion rate shows how many of your leads are turning into committed customers.

Formula:

Lead Conversion Rate = (Number of Conversions / Total Number of Leads) x 100

For example, if you had 500 leads and 50 of them converted into customers:

Then, Lead Conversion Rate = (50 / 500) x 100 = 10%

A high lead conversion rate? You’re in the right direction! But if it’s low, it’s a golden opportunity to fine-tune your approach. Maybe your leads need more nurturing, or perhaps your sales pitch needs a makeover. Whatever the case, this KPI guides you towards more effective strategies and, ultimately, more customers.

Remember, “conversions” typically refer to leads that become paying customers, but the definition can vary depending on your business goals. Some might consider a conversion to be a free trial sign-up or a consultation booking. The key is to be consistent in how you define a conversion for your specific business context.

2. Lead Response Time

Lead response time measures how quickly your team springs into action when a new lead comes knocking. It’s the time between a prospect expressing interest (by submitting a form, sending an email or making a call) and your team reaching out to them.

This CRM KPI is like a ticking time bomb — the longer you wait, the more likely your lead will lose interest or, worse, fall into the welcoming arms of your competitors.

Formula:

Lead Response Time = Time of First Response – Time of Lead Creation

For example, if a lead came in at 2:00 p.m. and your team responded at 2:30 p.m., your lead response time would be 30 minutes.

A low lead response time isn’t just about being quick — it’s about showing leads you’re attentive and eager to help. It’s your first impression!

Compare Top CRM Software Leaders

3. Average Sales Value

Average sales value (ASV), also known as average deal size, tells you how much revenue you’re generating per sale on average. Think of it as the “price tag” of your typical customer — are they window shopping or going all out?

This KPI is like a financial health check-up for your sales strategy. A rising ASV? You’re either landing bigger fish or upselling like a pro. Falling ASV? It might be time to revisit your pricing strategy or target market. It shifts the focus from how many customers you’re bringing in to how much value each one brings to the table.

Formula:

Average Sales Value = Total Revenue / Number of Sales

For example, if your total revenue for the month was $100,000 and you made 50 sales:

Then, ASV = $100,000 / 50 = $2,000

While a high ASV can be great, balance is key. You don’t want to sacrifice volume for value or vice versa. Use this CRM metric coupled with others for a full picture of your sales performance.

4. Customer Acquisition Cost (CAC)

Customer acquisition cost is the price tag of your growth. This KPI shows you exactly how much you’re spending to acquire new customers.

CAC is the cold, hard cash you’re shelling out for marketing, sales efforts and all the bells and whistles needed to turn a prospect into a paying customer. Think of it as the admission price to your customer base — and like any business owner, you want to make sure you’re not overpaying.

Formula:

Customer Acquisition Cost = Total Acquisition Expenses / Number of New Customers Acquired

For example, if you spent $50,000 on acquisition efforts and gained 500 new customers:

Then, CAC = $50,000 / 500 = $100

Instead of calculating this as a lump sum, break it down by marketing channels, customer segments or product lines to see where you’re getting the most for your money.

A low CAC isn’t always better if it means you’re skimping on quality leads. Balance your CAC with customer lifetime value. Spending $100 to acquire a customer who brings in $1,000 over their lifetime? That’s good business!

5. Website Conversion Rate

Website conversion rate is the digital equivalent of turning window shoppers into happy customers. It tells you how effectively your website is doing its job of transforming casual browsers into valuable leads or customers.

Formula:

Website Conversion Rate = (Number of Conversions / Total Number of Visitors) x 100

For example, if your website had 10,000 visitors last month and 300 of them took your desired action (like signing up for a newsletter or making a purchase):

Then, Website Conversion Rate = (300 / 10,000) x 100 = 3%

What counts as a “conversion” depends on your business goals. It could be a purchase, a form submission, a download or even just a click on a specific page. The key is to define what success looks like for your website and measure accordingly.

Compare Top CRM Software Leaders

6. Sales Cycle Length (SCL)

Sales cycle length measures the time it takes to close a deal from the initial contact with a prospect. A shorter SCL isn’t always better. A complex, high-value sale might justifiably take longer than a quick, transactional one. You must understand what’s “normal” for your business and continuously work on optimizing the process.

Formula:

Sales Cycle Length = (Sum of Total Number of Days to Close All Deals) / Number of Deals

For example, if you closed 10 deals that took a total of 500 days:

Then, SCL = 500 / 10 = 50 days

Tracking SCL helps you identify bottlenecks, forecast more accurately and set realistic expectations for both your team and your prospects. From the buyer’s perspective, SCL reflects their decision-making process. A cycle that is too short might mean rushed decisions, while a cycle that’s too long could lead to buyer fatigue.

7. Return on Investment (ROI)

“Was it worth it?” That’s what ROI answers. Return on investment shows you how much value you’re getting back for every dollar you put in. It’s the difference between being busy and being profitable — making more money than you spent.

Formula:

ROI = ((Net Profit – Cost of Investment) / Cost of Investment) x 100

For example, if you invested $10,000 in a marketing campaign that generated $15,000 in net profit:

Then, ROI = (($15,000 – $10,000) / $10,000) x 100 = 50%

In other words, you gained an additional 50% on top of your initial investment.

Apply ROI to individual campaigns, products or strategies to identify your top performers and those that might need tweaking. ROI helps you allocate resources, justify expenses and prove the value of your efforts.

While a positive ROI is generally good, context is important. A 20% ROI might be fantastic in one industry but mediocre in another. Compare your ROI to industry benchmarks and your own historical performance to get a full picture.

8. Email Click-Through Rate (CTR)

Email CTR measures how many recipients didn’t just open your email but found it compelling enough to click on a link within it. It tells you if your content is resonating with your audience, if your call-to-action is irresistible and if your timing is on point.

While related, CTR and open rate are different. A high open rate with a low CTR might indicate that your subject lines are great, but your content isn’t delivering.

Formula:

Email Click-Through Rate = (Number of Clicks / Number of Emails Delivered) x 100

For example, if you sent 10,000 emails, 2,000 were opened, and 200 people clicked on a link:

Then, CTR = (200 / 10,000) x 100 = 2%

While a high CTR is generally good, what’s considered “high” varies by industry and type of email. A promotional email might have a lower CTR than a transactional one, and that’s okay!

Compare Top CRM Software Leaders

8 CRM KPIs to Measure Customer Retention

Acquiring a new customer is just the beginning. The real challenge, and often the key to sustainable growth, lies in retaining those customers over time.

These customer retention KPIs provide critical insights into the strength and longevity of your customer relationships. From measuring the overall health of your customer base to pinpointing specific areas of satisfaction or concern, these indicators identify opportunities to improve customer loyalty.

9. Customer Retention Rate

Tracking customer retention rate is like asking, “Do they like us enough to stick around?” This CRM KPI is your loyalty meter, showing you what percentage of your customers are coming back for more. More than making sales, customer retention rate is about building lasting relationships.

It’s a reflection of your customer experience, helping you measure customer satisfaction, identify potential issues and prove the effectiveness of your customer service efforts.

Formula:

Customer Retention Rate = ((E – N) / S) x 100

Where:

- E = Number of customers at the end of a period

- N = Number of new customers acquired during that period

- S = Number of customers at the start of the period

For example, if you started the year with 1,000 customers, gained 200 new ones and ended with 900:

Then, Customer Retention Rate = ((900 – 200) / 1,000) x 100 = 70%

In other words, you kept 70% of your original customers over the period.

A 90% retention rate might be outstanding in a highly competitive market but concerning in a subscription-based model. Track it monthly or quarterly to spot trends and address issues before they become major problems.

10. Customer Satisfaction (CSAT)

Customer satisfaction (CSAT) shows you how happy (or not) your customers are with your products or services. It provides feedback on what you think you’re delivering compared to what your customers actually experience — highlighting the gap between your intentions and your customers’ perceptions.

CSAT helps you identify areas for improvement, predict customer behavior and guide your customer experience strategy. It’s the customer’s voice that guides your business towards excellence and loyalty.

Formula:

CSAT = (Number of satisfied customers / Total number of survey responses) x 100

For example, if you surveyed 500 customers and 400 reported being satisfied:

Then, CSAT = (400 / 500) x 100 = 80%

In other words, 80% of your surveyed customers are happy.

Don’t just rely on a single overall CSAT score. Break it down by touchpoints in the customer journey, product lines or service aspects. This helps you pinpoint exactly where you’re nailing it and where you might be dropping the ball.

11. Customer Churn Rate

Customer churn rate measures the percentage of customers who decide to end their journey with your business over a specific period. Unlike more celebratory metrics, churn rate is a reminder that customer retention is an ongoing challenge.

A high churn rate can indicate underlying issues such as poor customer service, product dissatisfaction or more attractive competitor offerings. Every lost customer represents immediate revenue loss and missing potential lifetime value and word-of-mouth marketing.

Formula:

Churn Rate = (Number of customers lost during a period / Number of customers at the start of the period) x 100

For example, if you started the quarter with 1,000 customers and lost 50:

Then, Churn Rate = (50 / 1,000) x 100 = 5%

A 5% monthly churn might be catastrophic for a subscription business but less concerning for a high-volume, low-loyalty industry.

The churn rate is a call to investigate. Why are customers leaving? At what point in their journey do they typically churn? Are there patterns among those who leave? These questions can lead to useful insights and drive strategic decisions.

Some level of churn is natural and even healthy. It can help refine your target market and ensure you’re focusing on the right customers. The goal isn’t necessarily zero churn, but rather a rate that allows for sustainable growth and profitability.

Compare Top CRM Software Leaders

12. Upsell Rate

The upsell rate measures your success in convincing existing customers to upgrade or purchase additional, higher-value products or services. This metric is less about acquiring new customers and more about deepening relationships with those you already have.

The upsell rate reflects your ability to align your offerings with your customers’ evolving needs. A healthy upsell rate suggests that you’re not just selling but continually adding value to your customer relationships.

Formula:

Upsell Rate = (Number of customers who purchased an upgrade or additional product / Total number of customers approached for upsell) x 100

Imagine you run a software company that offers a basic version of your product for $50/month. You also have a premium version at $80/month with additional features. Over a quarter, you offer the premium upgrade to 1,000 of your basic plan customers. Of these, 150 decide to upgrade.

The, Upsell Rate = (150 / 1,000) x 100 = 15%

This means that for every 100 customers you approach with an upgrade offer, 15 are saying yes.

Upselling is often more cost-effective than acquiring new customers. It builds on existing relationships, requiring less marketing spend and sales effort.

13. Customer Lifetime Value (CLTV)

Customer lifetime value (CLTV) offers a glimpse into the future value of your customer relationships. It estimates the total revenue you can reasonably expect from a single customer account throughout its relationship with your company.

CLTV shifts the focus from short-term transactions to long-term relationship value, encouraging businesses to invest in customer satisfaction and loyalty.

Calculating CLTV can be complex, as it considers multiple factors:

CLTV = (Average Purchase Value x Purchase Frequency x Customer Lifespan)

Where:

- Average Purchase Value: The typical amount a customer spends per transaction.

- Purchase Frequency: How often a customer makes a purchase over a given period.

- Customer Lifespan: The average duration of a customer’s relationship with your business.

Imagine you run a subscription-based meal delivery service. After analyzing your data, you find:

Average Purchase Value: $50 per month

Purchase Frequency: 12 times per year (monthly subscription)

Average Customer Lifespan: 3 years

Then, CLTV = $50 x 12 x 3 = $1,800

This means that, on average, each customer is worth $1,800 to your business over their entire relationship with you.

But let’s take it a step further. CLTV becomes even more powerful when you factor in profit margin. If your profit margin is 25%, the actual value of this customer becomes:

Profit – Adjusted CLTV = $1,800 x 25% = $450

This $450 is the profit you can expect to generate from an average customer over their lifetime with your business.

Two customers might make the same purchase today, but one could have a CLTV ten times higher than the other. This insight can dramatically change how you approach each relationship.

14. Net Promoter Score (NPS)

Net promoter score (NPS) is a straightforward yet powerful metric that depends on a single survey question: “On a scale of 0-10, how likely are you to recommend our company/product/service to a friend or colleague?” Based on their responses, you can categorize customers into three groups:

- Promoters (score 9-10): Your enthusiastic fans.

- Passives (score 7-8): Satisfied but unenthusiastic customers who might be swayed by competitors.

- Detractors (score 0-6): Unhappy customers who might damage your brand through negative word-of-mouth.

Formula:

NPS = % of Promoters – % of Detractors

Let’s look at a simple example:

Let’s say you surveyed 200 customers and got these results:

- 100 rated you 9 or 10 (Promoters)

- 60 rated you 7 or 8 (Passives)

- 40 rated you 0 to 6 (Detractors)

To calculate your NPS:

- Calculate the percentage of Promoters: 100/200 = 50%

- Calculate the percentage of Detractors: 40/200 = 20%

- Subtract: 50% – 20% = 30%

Your Net Promoter Score is 30.

NPS can range from -100 (if every customer is a detractor) to +100 (if every customer is a promoter). A positive NPS is generally considered good, and an NPS of 50 or above is excellent in most industries.

What makes NPS so valuable is its simplicity and actionability. It’s easy for customers to understand and quick for them to answer, leading to higher response rates.

Compare Top CRM Software Leaders

15. Sales Pipeline Velocity

Sales pipeline velocity measures how quickly potential deals move through your pipeline and turn into revenue. It answers the question: “How much revenue can we expect to generate per day from our current pipeline?”

This CRM metric combines four critical elements of your sales process:

- Number of opportunities in your pipeline

- Average deal value

- Win rate (or conversion rate)

- Length of your sales cycle

Formula:

Velocity = (Number of Opportunities × Average Deal Value × Win Rate) ÷ Length of Sales Cycle (in days)

For example, consider your sales team has the following metrics:

- 100 opportunities in the pipeline

- Average deal value of $10,000

- Win rate of 25%

- Average sales cycle of 30 days

Then, Velocity = (100 × $10,000 × 0.25) ÷ 30 = $8,333

Why is this KPI so powerful? It shows you how many deals you’re working on, how valuable they are, how likely you are to win them and how quickly you’re moving them through the pipeline.

Moreover, it allows you to pinpoint areas for improvement:

- A low number of opportunities? Focus on lead generation.

- Small average deal value? Look into upselling or targeting larger clients.

- Poor win rate? Improve your sales techniques or qualify leads better.

- Long sales cycle? Streamline your process or improve follow-up practices.

By tracking sales pipeline velocity over time, you can see if your sales efficiency is improving. An increase in velocity means you’re generating revenue faster, which is crucial for cash flow and growth.

16. Pipeline Stage Conversion Rate

The pipeline stage conversion rate shows you exactly where prospects are navigating smoothly through your sales process and where they’re hitting roadblocks. This metric measures the percentage of opportunities that successfully move from one stage of your sales pipeline to the next.

Formula:

Conversion Rate = (Number of opportunities that moved to the next stage ÷ Total number of opportunities in the starting stage) × 100

Let’s say your sales pipeline has four stages:

- Lead qualification

- Discovery

- Proposal

- Closing

And you want to calculate the conversion rate from discovery to proposal. In a given month:

- 100 opportunities were in the discovery stage

- 60 of these moved forward to the proposal stage

Conversion Rate = (60 ÷ 100) × 100 = 60%

This means 60% of opportunities successfully moved from discovery to proposal, while 40% dropped off.

Pipeline stage conversion rate helps you identify where prospects are most likely to drop off, allowing you to allocate more resources to critical stages. If certain stages consistently have low conversion rates, it might be time to reassess that part of your sales approach.

Compare Top CRM Software Leaders

CRM KPIs vs. CRM Metrics

CRM metrics are like the raw ingredients in your customer relationship recipe. They are the fundamental measurements that track various aspects of your customer interactions.

Examples include:

- The number of new leads generated

- Email open rates

- Average time to respond to customer inquiries

- The number of support tickets resolved

See, these metrics are valuable data points. But on their own, they don’t necessarily tell you if you’re winning or losing the customer relationship game.

CRM KPIs, on the other hand, are the high-level indicators that directly align with your business objectives. They tell you if you’re ahead or behind in achieving your customer relationship goals. Examples include:

- Customer Lifetime Value (CLTV)

- Customer Retention Rate

- Net Promoter Score (NPS)

- Sales Pipeline Velocity

KPIs are often composed of multiple CRM metrics and provide a broad view of performance. They answer critical questions about the health and direction of your customer relationships.

Why Are CRM KPIs and CRM Metrics Important?

- Performance Measurement: CRM KPIs transform subjective impressions into quantifiable data, allowing you to track progress over time, compare performance across teams, and identify trends and patterns in customer behavior.

- Decision Making: In business, gut feelings only get you so far. CRM KPIs and metrics provide the hard data needed to make informed decisions on allocating resources effectively, prioritizing projects and identifying areas needing improvement.

- Customer Satisfaction and Retention: Happy customers are loyal customers. CRM KPIs and metrics help you keep customer satisfaction in check and take proactive steps to improve retention.

- Sales and Revenue Growth: KPIs like sales pipeline velocity show how efficiently you’re converting opportunities into revenue, while metrics like average deal size can guide your upselling and cross-selling strategies.

- Accountability and Transparency: CRM KPIs and metrics create a culture of accountability within your organization, with clear, measurable goals set for individuals and teams.

How To Measure CRM KPIs

Measuring CRM KPIs is way easier with a well-crafted dashboard, which displays all your crucial KPIs in living color. With real-time data updates, you can spot trends, identify issues and seize opportunities faster.

Your dashboard should be as unique as your business. Want to focus on customer acquisition? Retention? Upselling? Your dashboard should reflect your priorities. Modern dashboards allow you to click, drag and explore — like having a conversation with your data.

For example, here’s a comprehensive lead generation dashboard from HubSpot CRM, with insights into a company’s Q1 campaign performance.

A sample lead generation dashboard from HubSpot CRM representing a company’s Q1 campaign performance. Source

Let’s see how it contributes to measuring and understanding important KPIs.

- Contacts created over the last 30 days lets users quickly calculate the daily fluctuations in new contact acquisition.

- New contacts by source reveal where leads are coming from and how well the website is retaining visitors’ interest.

- The website analytics widgets make it easy to assess which types of content are driving traffic.

- Marketing qualified leads by original source helps decision-makers with resource allocation, focusing efforts on the most effective lead generation channels.

Compare Top CRM Software Leaders

Top 5 CRM Software With KPI Dashboards

Now, let’s explore some of the best CRMs that have transformed boring spreadsheets into data hubs that let you build visually pleasing, easy-to-understand dashboards. From real-time updates to customizable views, these dashboards are truly helpful in keeping track of your metrics.

Zoho CRM

Zoho CRM comes with highly customizable dashboards that update with real-time data. They allow you to go beyond basic sales figures and study campaign effectiveness or customer service metrics. You can tailor these dashboards to your specific needs to gain a complete view of how your CRM is impacting various business facets.

Learn how to manage reports and create a dashboard with Zoho. Source

Salesforce

Salesforce takes a dynamic approach to dashboards, offering interactive features for deeper analysis. You can choose from a vast library of pre-built sales KPIs or create custom metrics. Interactive filters and the ability to drill down into specific data points can help you understand the factors impacting your sales performance across various channels or product lines.

Get started with analytics dashboards on Tableau from Salesforce with this tutorial. Source

HubSpot CRM

HubSpot keeps things user-friendly with drag-and-drop customization options for their CRM dashboards. While these dashboards cater more towards marketing-centric KPIs, providing clear visibility into lead generation and conversion rates, they also offer some customization to track sales and customer service KPIs.

Explore 10 essential reports that you should add to your Hubspot dashboard. Source

Pipeliner CRM

Pipeliner CRM prioritizes visuals for its dashboards, making them ideal for pipeline management. These dashboards excel at tracking conversion rates between different stages within your sales pipeline. By analyzing this data, you can identify bottlenecks and optimize your deal flow, ultimately improving sales forecasting accuracy.

Dive into Pipeliner dashboard — power panel’s basics in this tutorial. Source

Oracle Sales Cloud

Designed for large enterprises, Oracle Sales Cloud offers feature-rich dashboards with extensive customization options. This allows you to study complex sales data and create custom KPIs to suit your needs. There are also powerful tools that provide complete sales performance analysis and forecasting capabilities.

Watch and learn how to create your first dashboard in Oracle Analytics. Source

Compare Top CRM Software Leaders

CRM KPI Tracking — Best Practices

Identify relevant KPIs

Choose metrics that align with your business goals. Strike a balance between leading and lagging indicators to get a thorough view of your performance.

Implement an effective tracking system

Select a user-friendly CRM software with rich reporting features and dashboards and set up automated data collection where possible.

Monitor CRM metrics regularly

Establish a routine review schedule and create easy-to-read dashboards for at-a-glance insights. Share reports with relevant team members to keep everyone aligned and informed.

Continuously refine your KPI strategy

Regularly reassess the relevance of your chosen KPIs and be open to adding or removing metrics as your business evolves. What worked last quarter might not be what you need now.

David H. Deans, Principal Consultant and founder of GeoActive Group, said:

Businesses should review and adjust their CRM KPIs every six months (on average), but more frequently if the marketplace shifts.

Ensure KPI targets are SMART: Specific, Measurable, Achievable, Relevant and Time-bound. That said, be bold, be brave and dare to be different in setting stretch goals and objectives.

Compare Top CRM Software Leaders