High levels of tax evasion are considered one of the main reasons Indonesia only collects just over 10% of Gross Domestic Product (GDP) in taxes, around half of the regional average. However, to date, it has been challenging to accurately estimate the pervasiveness of tax evasion and identify the types of taxpayers more likely to evade. Relying on tax returns can be fraught as taxpayers often misreport, and it is hard to prove this without third-party information sources, such as bank account data. On the other hand, using surveys to directly ask taxpayers if they evade taxes does not tend to result in honest answers.

In this new World Bank study, we implement a “double list experiment” which indirectly reveals the depth and breadth of tax evasion in the formal sector of the Indonesian economy. Double list experiments are considered best practice for measuring sensitive topics, such as drug use and risky sexual behavior, but this is the first time it has been used to examine tax evasion.

The results of this double list experiment suggest that around 25% of formal firms indirectly admit to paying tax and tax evasion is particularly high among firms that don’t export, compete with the informal sector, and find tax administration to be a burden.

To understand how list experiments work, let us first consider a “single” list experiment. In a single list experiment, respondents are randomly allocated across two groups (a control group and a treatment group) and presented with a list of statements. The random assignment of respondents to control and treatment groups ensures that, on average, the characteristics between these two groups are similar. In our experiment, we present the control group with a list of 3 statements about their business practices. They are asked to respond by simply stating the number of true statements without identifying which ones are true. We can then calculate the average number of true statements for the control group.

Then, we turn to the treatment group and present them with the same list of 3 statements, but we also add one extra statement about evading taxes. They are also asked to respond by simply stating the number of true statements without identifying which ones are true. We then calculate the average number of true statements for the treatment group. By comparing the average number of true statements between the treatment and control groups, we can infer that any difference between these two groups is attributable to the additional statement about tax evasion. Regression analysis is then used to check whether this difference is statistically significant.

Now, for a double list experiment, we simply switch the two groups around and run a similar list experiment again. Consistent results across both experiments provide strong evidence of its validity.

Table 1 shows the design of our double list experiment, in which an additional statement about evading taxes is included in the list shown to respondents in the “treatment” group (that is, Group B in List Experiment 1 and Group A in List Experiment 2).

This double list experiment was part of one of the largest World Bank Enterprise Surveys (WBES) to date, covering a nationally representative sample of 2,955 registered firms with at least five employees across all provinces in Indonesia. WBES are among the most comprehensive and reliable surveys about the activities of firms in low- and middle-income countries, collecting detailed information about firm attributes, including their operations and engagement with governments. We utilise this extensive information collected in the 2023 Indonesia WBES to examine the types of firms most likely to evade tax.

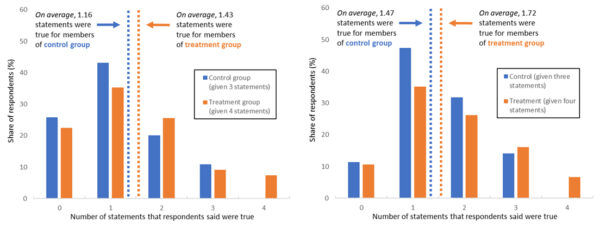

The results show that around one quarter of formal firms in Indonesia indirectly report evading taxes. Figure 1 shows the share of respondents selecting the number of statements in each list in the treatment and control groups, with the difference in average responses being the implied tax evasion rate. The “double” list experiment produced internally consistent estimates of around 26% (varying from 25% to 27%) of firms admitting to not paying all the taxes they are required to pay. This result is almost identical across both experiments, which provides considerable reassurance of its accuracy.

Figure 1: Distribution of responses by group and list

Source: Revealing Tax Evasion : Experimental Evidence from a Representative Survey of Indonesian Firms.

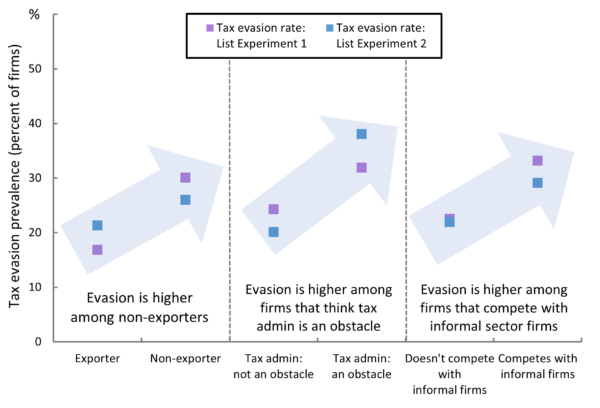

Firms that don’t export, compete with the informal sector, and find tax administration to be a burden are the most likely to evade tax. We use a machine learning algorithm to identify, among the extensive amount of information captured about firms in the 2023 Indonesia WBES, the attributes associated with higher levels of tax evasion. Figure 2 shows the three attributes of firms where the highest rates of tax evasion were detected across the double list experiment. For example, the rate of tax evasion varies from 32%-38% for businesses that find tax administration to be an obstacle compared to 20%-24% for businesses that don’t. There was more limited variation based on other attributes, highlighting how widespread tax evasion is across most types of firms.

Figure 2: Distribution of responses by group and list

Source: Revealing Tax Evasion : Experimental Evidence from a Representative Survey of Indonesian Firms.

This study illustrates how common tax evasion is among firms in Indonesia and the types of firms most likely to evade tax. The results show that substantially more revenue could be collected if the government could reduce tax evasion by formal firms. In addition, it helps guide the revenue authority (the Directorate General of Taxes) as to the types of firms they should consider focusing their compliance efforts on (e.g., non-exporting firms). Further, the higher rates of evasion by firms that see tax administration as a major obstacle provide evidence that efforts to simplify the Indonesian tax system (which is relatively complex) may lead to increases in compliance and, consequently, revenue.

Read the full paper, data replication package and the 2023 Indonesia World Bank Enterprise Survey.