It is a chilly Friday in November… Black Friday no less… and a few MMO companies that I watch have released their Q3 financials, so it seems like a moment to take a quick pass through those. Sometimes I post about them individually when there is significant news, and sometimes I am feeling tired and just want to note things in passing.

Remember in past posts where I explained how acquisitions are often a cheap way to get a revenue boost quickly? Well, Daybreak scooping up Singularity 6, the makers of cozy MMO Palia, paid off in that they got to claim the revenue while the transaction was earnings neutral.

That put Daybreak, which had been slipping on the margins front, back at the top of the EG7 studios as Big Blue Bubble’s My Singing Monsters reign continued to taper off… though their margins are still pretty monster, being nearly double Daybreak’s

Revenue was also driven by LOTRO and its legendary server launch, which got some players back into the fold, and EverQuest and its 25th anniversary celebrations, which gave EG7 its best quarter this year.

Related links:

As for things coming up, they appear to be prepping Palia and its cash shop model for an exit from beta and a console launch while the promised H1Z1 title, mentioned last year at the fall 2023 Stockholm Syndrome presentation, got no mention on the slide deck and is listed as “Currently in pre-production phase” in the interim report. Not sure what that really means, but it could still be on for 2026. And then there is the next EverQuest title, slated for 2028 on the chart from EG7.

There have been some leaks around work starting on a new Norrath title, but nothing substantial and we are still a few years out.

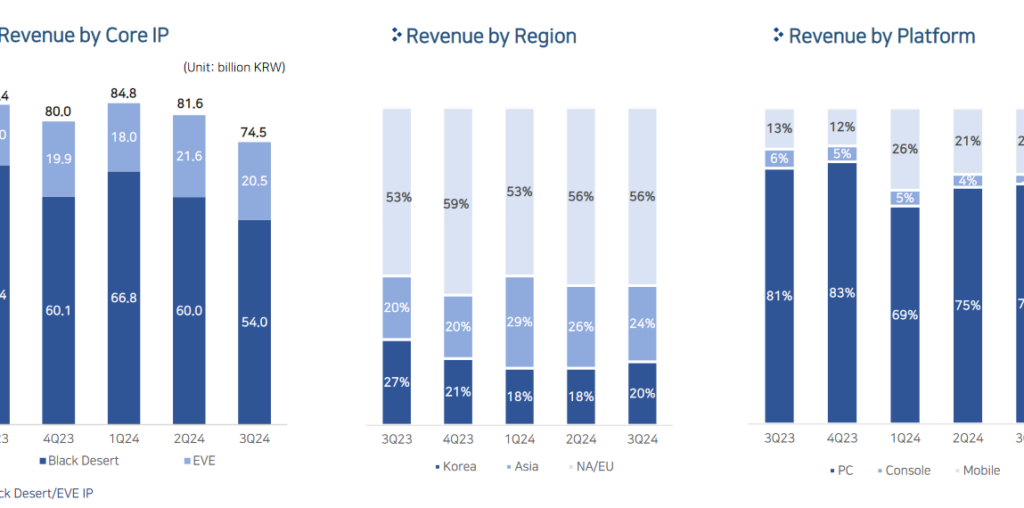

Primarily of interest to me as the owners of CCP, the studio responsible for EVE Online, the Q3 numbers overall were down across the board… across the board being just the Black Desert and EVE Online IPs, PA having continued to fail to launch anything else.

While EVE Online was down compared to Q2, it was not by that much and it remains up relative to the three quarters before that, Q1 and Q4 & Q3 of 2023. Again, the EVE IP isn’t broken out into detail, and there is no doubt some EVE Echoes licensing revenue coming in from NetEase, but that seems likely to be mostly EVE Online.

Related links:

The forward looking “growth strategy” in the presentation leans heavily on EVE Online’s Revenant expansion, the recently launched EVE: Galaxy Conquest, the now mythical Crimson Desert launch, and the garbage cryto dumpster fire that is EVE Frontier.

You tell me if any of that is a good bet.

That is all of two bullet points. I thought about going into NCsoft’s Q3 2024 revenue, but I had even less to say about that, save for the fact that the Guild Wars 2 Janthir Wilds expansion didn’t exactly peg the revenue meter. Was the player housing not good enough? Were you not entertained?

Still, they have Throne & Liberty revenue to look forward to.

In any case, Q4 and the holidays and the full year revenue pictures are generally more entertaining. And I don’t even have to think about that until February of 2025.