Staff reporter

Hong Kong is reportedly planning a tax exemption on gains from cryptocurrency for private equity funds, hedge funds and billionaire families to step up efforts to develop itself as a global crypto hub amid the historic surge of bitcoin, according to reports.

The plan was included in a 20-page proposal, which is currently undergoing a six-week consultation.

The Hong Kong administration, reports said, finds tax levy is “one of the key considerations” for the asset managers when deciding on their location for operations and plans to offer them a “conducive environment.”

Patrick Yip, vice chair and international tax partner at Deloitte China, thinks the exemption would be an important step for Hong Kong, as some family offices in the city now allocate up to 20 percent of their portfolio to digital assets.

Hong Kong also plans to apply a tax break to private credit investments and other assets, according to reports.

While the city imposes no capital gains tax and has no plan to do so in the foreseeable future, the Inland Revenue Department will collect tax from the profits derived from Hong Kong’s initial coin offerings and digital asset trading, whose rates are no higher than 16.5 percent of the assessable gains.

The figure is already lower than those in the West. The United States imposes a tax of up to 37 percent for gains from crypto held for less than one year and Italy is set to hike the capital gains tax on bitcoin to 42 percent from 26 percent.

Hong Kong’s exemption may make it more competitive than Singapore as it applies a 9 percent goods and services tax to fees for trading crypto assets.

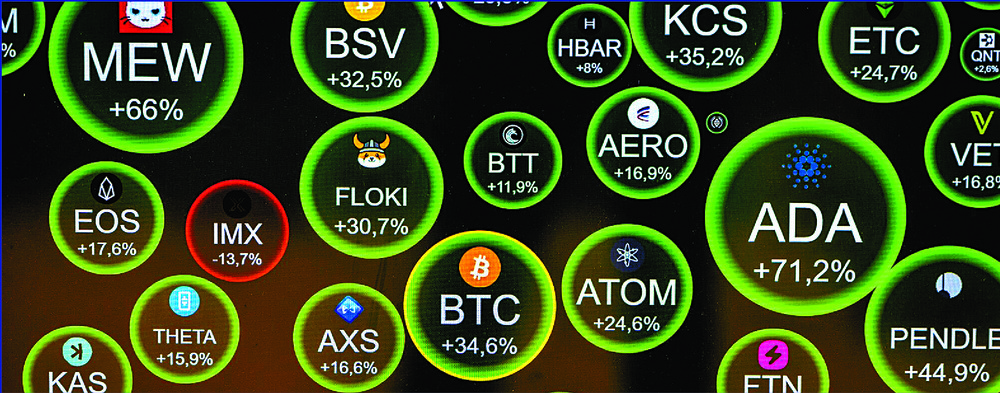

It comes as bitcoin once surged as much as 47 percent after the pro-crypto Donald Trump won the US presidential election in early November and announced nominations that gave crypto fans hope.

Bitcoin rallied 1.89 percent to US$95,149 (HK$742,162) in Hong Kong at 7.44pm yesterday.

Hong Kong has been striving to transform itself into a global virtual asset trading hub since 2022, but its securities regulator only granted licenses to three exchanges so far, in addition to concerns about crypto scams amid the crackdown on JPEX.