Fintech startup DigMo, which gamified wealth-building tools to low and middle-income earners, has launched in Zambia.

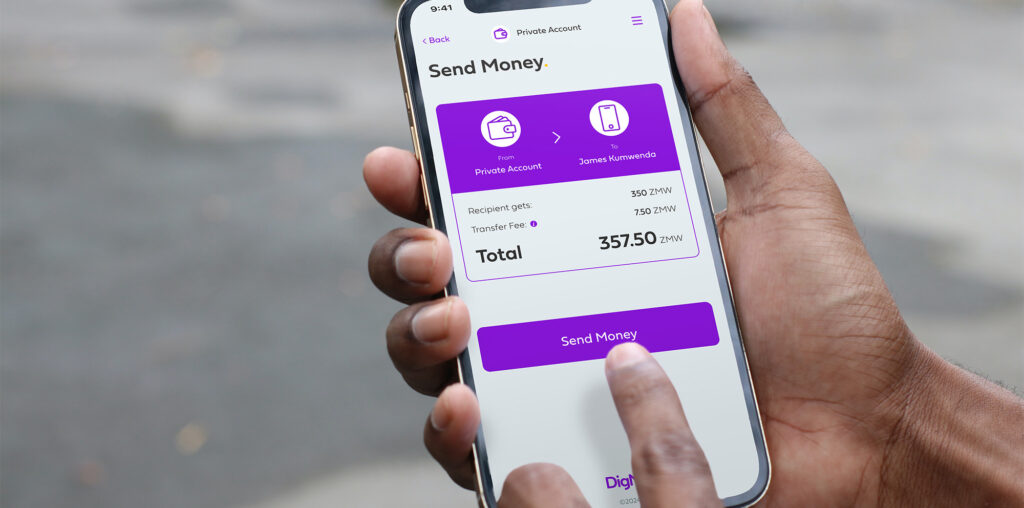

Licensed by the Bank of Zambia to operate a wallet, DigMo offers a secure, free digital money account with a special account for users to play a “financial planning game” which incentivises customers to get started putting money away for the future. By giving customers the chance to win big rewards, the startup says it is encouraging sustainable habits.

With an initial rollout in Zambia, DigMo wallet’s first offering, Save to Win, makes putting money away regularly, easy and rewarding with no fixed costs or fees. Save to Win allows users to start with small amounts – from just ZMW10 (US$0.37) – for the chance to win prizes of up to ZMW500,000 (US$19,000).

“We are committed to financial planning innovation for low and middle-income earners across Africa. To achieve this meaningful impact, we approach this like a game studio – where we constantly create and test many new products until we find those with an outsized impact,” said Sylvia Brune, CEO of DigMo Group.

“If we just take existing products and make them more affordable or accessible, it is unlikely that we can dramatically change behaviours. To succeed, we have engaged directly with users, observing and learning from them to develop DigMo, a solution that will dramatically improve their financial well-being and meet their unique needs.”