Did you ever see those Magic Eye posters that were popular in the 90’s that had a hidden image within the picture and you had to adjust your eyes just right and stand a certain distance away from the picture to see the image?

Did you ever see those Magic Eye posters that were popular in the 90’s that had a hidden image within the picture and you had to adjust your eyes just right and stand a certain distance away from the picture to see the image?

I personally remember loving those as a kid and I really don’t know what happened to them, but when I first started thinking of today’s lesson these pictures came to my mind. That’s because just like those pictures, the market contains a “hidden” message that only those trained in the art and skill of price action trading will be able to see properly. To the average person looking at a price chart, they will see a bunch of seemingly random bars that mean nothing, but the price action trader sees the message that the footprint of money (price action) on the charts is telling them.

In this lesson, we are going to discuss how to start seeing the hidden messages in the market and what they mean.

Listening to The Market and Hearing What It’s ‘Saying’

In order to hear what the market is trying to tell you, you must first know exactly what to listen for. What you’re listening for are price action clues, left behind as the “story” of the market plays out across a chart. And just like reading a book, in order for the current “page” to make sense, you have to know what happened before, so that means you have to know how to analyze the past price action to make sense of the current price action and use that to make an educated prediction about what MIGHT happen next.

You see, any single bar, by itself, really means nothing. It’s the bar COMBINED with the surrounding market structure or context that paints the picture of that market for you. Once you start following a market long enough you will begin to know it intimately and start to get a gut feel for it, this comes with time, but it’s truly what “hearing the market” is all about.

Now, HOW EXACTLY do you listen to the market and “HEAR” what it’s trying to tell you? You do this through price action analysis and I am going to give you some specific examples of this below…

The charts are the market’s way of “speaking” to us, but if you don’t know what to listen for, the message will go right over you head. Let’s take a look at some of the main pieces of the price action language of the market…

Recent Price Behavior and Market Conditions

The first major message you need to learn to hear on the charts is whether or not the market is trending. If it is trending, that’s very, very good for you because trend trading is absolutely the easiest way to make money in the markets. If it’s not trending then it’s probably consolidating either in a large trading range (which can be good to trade) or a very small and more random trading range (choppy and not good to trade usually). This is an important thing to learn to decipher early-on because it really dictates which direction you’re looking to trade and what you’re overall approach should be to that market in that condition.

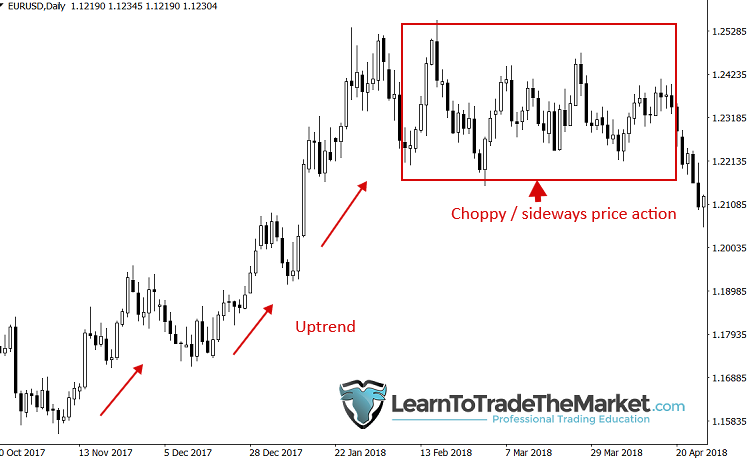

Notice in the chart below that price moved from a period of choppy / sideways (small range) price action to a strong breakout, then a pull back to the trading range midpoint, before an uptrend took hold and carried price higher for months…

In this image, price was trending higher aggressively before pausing and entering a long period of sideways price action. Obviously, the trending periods were much easier to trade and more fruitful. Yet, many traders continue to trade (and lose their money) because they don’t know how to interpret the language of price action properly, which was clearly telling them the market was entering a period of more difficult to trade PA.

Key Levels and “Perfect” vs. “Imperfect” Technical Analysis

Perhaps the next most important “message”the market can send you is HOW price is reacting / behaving around key chart levels. Sometimes, a market will respect nearby levels very, very well (almost exact or even exact in many cases). Sometimes, not so much. I prefer to trade markets that are respecting key levels because that tells me that for whatever reason, this might continue in the near future. Once you identify these levels you can then wait for high-probability price action signals to form at them. However, if price is not respecting levels very well, you may want to avoid that market for now.

How price reacts around obvious key levels is extremely important; are we technically ‘perfect’ at the moment or are the technicals messier and imperfect?

False-Breaks of Key Levels and Contrarian Signals

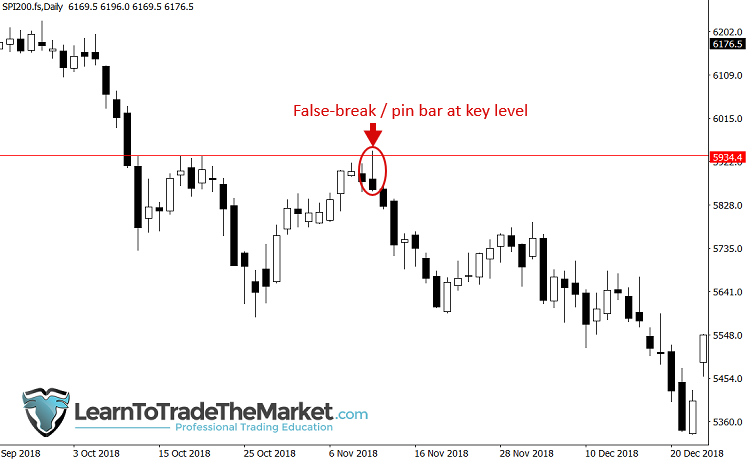

Human nature and are brain wiring makes most people really, really bad traders. It’s because when we look at a chart and we see it going up, we FEEL like it’s going to keep going up, but this is usually about the time it’s going to go down again, lol. It can be very, very frustrating to the beginner or to the trader who doesn’t yet understand how to listen and HEAR what the price action is telling them. Once thing I’ve written about extensively both on my blog and in my trading courses, is how you have to trade like a contrarian to profit in the market. There are price action clues that tip us off to when a contrarian move is underway and price is about to head back the opposite direction. One of them is a false break of a level and of course there is the fakey trading strategy as well. These are some of my favorite patterns to trade because it shows the underlying market psychology and is a powerful clue as to what might happens next.

Note, in the chart below price made a false-break of resistance before reversing lower again in aggressive fashion.

Failed Price Action Signals Are Awesome. Wait, What?

Ah, the failed price action signal, yes they can be painful and indeed sometimes a trade simply doesn’t work out, that’s a fact of trading you have to deal with through proper risk management. BUT, (you knew a but was coming) sometimes failed price action signals can be very powerful signals themselves. For example, if you see price violate the high or low of a particular signal that you thought was going to have the opposite outcome, ask yourself what is that telling you? What is the MARKET TRYING TO TELL YOU???

Don’t over-think it. If you see a price action signal fail, that is a strong clue that price may keep moving in that same direction…

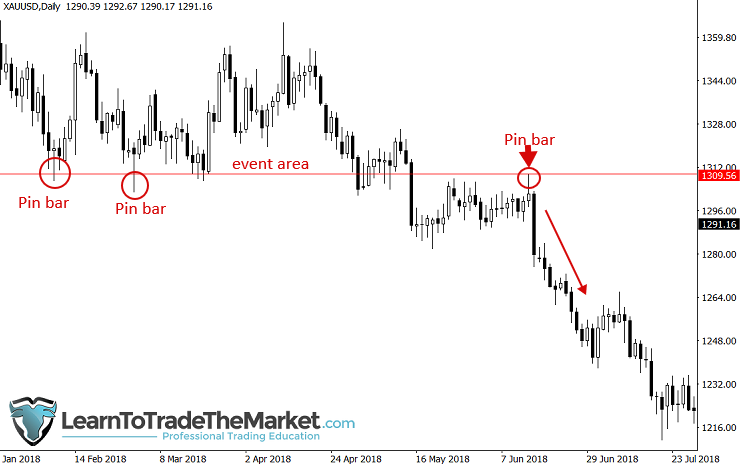

Event Areas and Recent Profitable Price Action Signals

If you don’t know what are event areas, I suggest you read my lesson on the topic, because they are very important message areas that the market wants you to watch. When you see multiple price action signals that worked out coming from the same or similar area, you may have an event area, and if you see another signal at that area, it’s a very strong signal to consider.

Notice the pin bars this level, when the last one on the right formed you missed out on a hugely profitable move if you didn’t know how to interpret the message the market was giving you…

I Need You to Think Beyond the Actual Act of Trading

Technical Analysis is a language and we need to interpret that language if we want to have a chance at long-term, on-going trading success.

Like most wealthy business people will tell you; a lot of listening, hear what others have to say and gather feedback, then make a decision. It’s often said ‘”Be the last guy in the room to speak”; a cliche business phrase from most business leadership books, but it happens to be true. Translated into the trading world, we can ‘listen’ to the markets message and then let the market show us what it wants to do, then we use that gathered feedback to form our opinion, make a plan and then act accordingly.

However, it’s more than just “listening to the message”, you have to combine the messages the market is sending you (see above examples) and formulate those messages into the ‘story’ being told on the chart from left to right. You want to paint a visual “map” by annotating the technical factors on your charts just like I do in my weekly market commentary.

We use the message to both take trades AND to avoid trades and to develop a general feel of market conditions, much like reading the weather and forming forecasts. You’re not acting on every forecast you make but some of them might prove very useful for planning what you will do next.

In that vein, you want to act on the clearest messages and act on the strongest market forecasts only, the messages we interpret are not simply what I would normally teach as confluence of factors. The concept of “listening to the market’s messages” really is something greater than just spotting a trade setup. We are talking about listening to the message the market is telling us about the smart money, with that info we can decipher many many things, we are going far beyond the idea of “hey I can see 1 + 2 things, so now I must take action.” Once you reach a certain point in your price action mastery, you will being to feel like the market is actually “speaking to you” and telling you what to do rather than you trying to tell it what to do (which never works fyi).

Conclusion

My trading approach is based around watching charts daily and interpreting the messages being broadcast from the market. We need to be there to listen for it, map it and interpret it. Think of it as reading a page in a book every day. In the trading world, that means at the New York close every day Monday to Friday, I am there listening to the message being broadcast (i.e. reading the price action, mapping the charts and deciphering its hidden message). However, that does not mean that I am sitting there ALL day staring at the charts. I have my planned times to check the markets each day and if I am not “hearing” anything from the charts that day then I forget about them until tomorrow. I don’t sit there trying in vain to “force” something that isn’t there

Nine times out of ten I don’t take action, but that one time out of ten that I do take action I am pulling the “trigger” on the trade like a deadly sniper waiting to take the “kill shot” once the proper trade setup is in focus. If you want to learn more about listening to what the market is saying and learning to interpret it effectively, check out my professional trading course for more information.

Please Leave A Comment Below With Your Thoughts On This Lesson…

If You Have Any Questions, Please Contact Me Here.