Visualizing the Decline of the Canadian Dollar

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

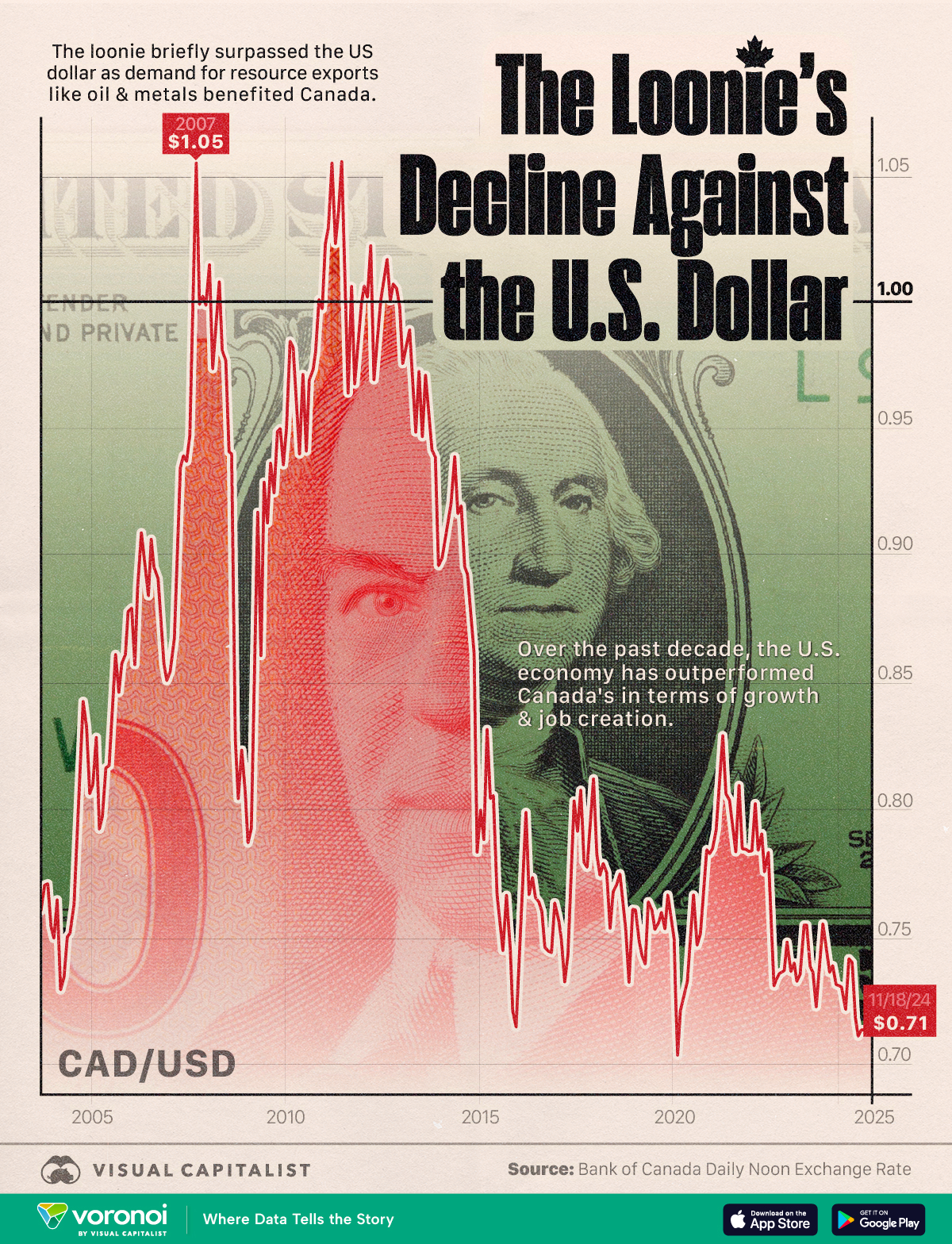

The Canadian dollar has fallen to its lowest level in years. In late October, the loonie dropped below 72 cents USD for the first time since 2020.

This graphic highlights the USD to CAD exchange rate from 2004 to 2024, based on data from the Bank of Canada Daily Noon Exchange Rate.

Historical Performance of the Loonie

Over the last 20 years, the Canadian dollar has experienced notable fluctuations.

In 2007, the loonie briefly surpassed the U.S. dollar as global demand for resource exports like oil and metals strengthened Canada’s economy. In the early 2010s, the Canadian dollar again reached parity with the U.S. dollar, driven by rising commodity prices.

| Date | CAD/USD |

|---|---|

| 2007-05-01 | 0.90 |

| 2007-11-07 | 1.09 |

| 2008-01-02 | 1.01 |

| 2009-01-02 | 0.83 |

| 2010-01-04 | 0.96 |

| 2011-01-05 | 1.01 |

| 2012-01-05 | 0.98 |

| 2013-01-04 | 1.01 |

| 2014-01-06 | 0.93 |

| 2015-01-05 | 0.85 |

| 2016-01-20 | 0.68 |

| 2017-01-05 | 0.76 |

| 2018-01-05 | 0.81 |

| 2019-01-04 | 0.75 |

| 2020-01-06 | 0.77 |

| 2021-01-05 | 0.79 |

| 2022-01-04 | 0.79 |

| 2023-01-05 | 0.74 |

| 2024-01-05 | 0.75 |

| 2024-11-14 | 0.71 |

However, over the past decade, the U.S. economy has outperformed Canada’s in terms of growth and job creation, leading to a gradual weakening of the loonie.

Will the Loonie Continue to Fall?

Several factors contribute to the loonie’s current decline, with interest rate decisions playing a significant role. Recent rate cuts by the Bank of Canada have reduced the appeal of Canadian assets to overseas investors.

In addition, the U.S. dollar has strengthened amid the re-election of former President Donald Trump.

Trump’s has promised to introduce tariffs on all U.S. imports. With 75% of Canada’s exports destined for the U.S., the implementation of such tariffs could further weaken the loonie.

Learn More on the Voronoi App

If you enjoyed this graphic, make sure to check out this graphic that shows witch assets are most correlated to the USD.