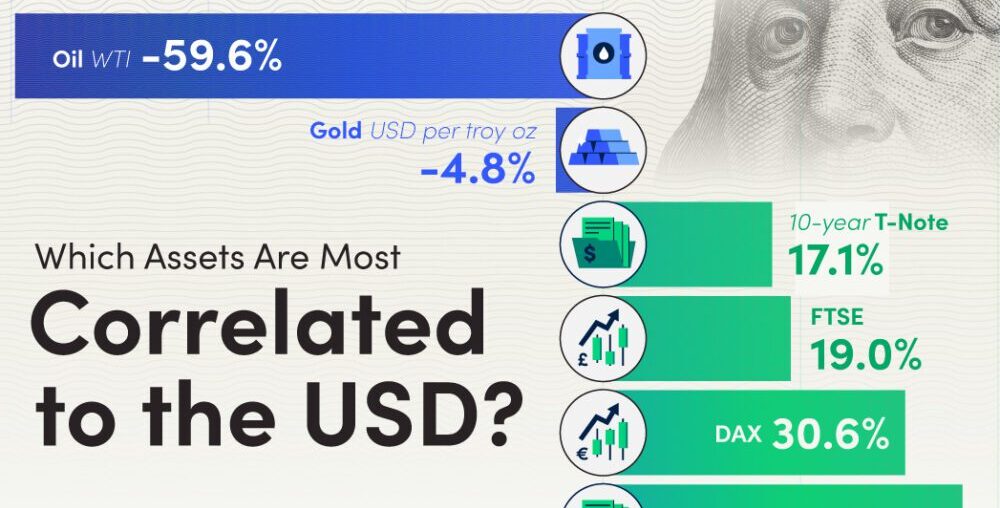

Which Assets Are Most Correlated to the USD?

Building a well-balanced, diversified portfolio involves including assets with varying correlations. The U.S. dollar (USD), with its weak or negative correlations to other assets, can be a valuable addition to investors’ portfolios.

This graphic, created in partnership with OANDA, illustrates the USD’s correlations with other assets and indices. This insight can provide assistance for evaluating the role of USD in investment portfolios.

| Asset | Correlation |

|---|---|

| S&P 500 | 38.6% |

| Apple | 38.0% |

| DJIA | 37.1% |

| 2-year T-Note | 36.4% |

| DAX | 30.6% |

| FTSE | 19.0% |

| 10-year T-Note | 17.1% |

| Gold | -4.8% |

| Oil | -59.6% |

Equities

Among the assets selected, the USD has the highest correlation with U.S. equities. The link with the S&P 500 and Apple’s stock are strongest, closely followed by the Dow Jones Industrial Average.

However, it’s important to note that any correlation below 40% is considered ‘weak.’ This suggests that adding the USD to a portfolio with exposure to any of the assets in this dataset can still enhance diversification.

The USD also shows a weak positive correlation to the German DAX and the U.K.’s FTSE.

Fixed Income

The 2-year and 10-year T-notes also exhibit positive correlations to the USD.

The 2-year note’s correlation is significantly stronger (though still ‘weak’). This is intuitive, given that shorter-term price fluctuations in the USD are less likely to impact investors’ expectations in the longer-term.

Commodities

The only assets in the dataset with negative correlations to the USD are the two commodities: oil and gold.

The relationship between the USD and these commodities is complex. However, one key driver of the relationship is that both gold and oil are typically priced in U.S. dollars, meaning a stronger dollar tends to drive prices down (and vice versa).

Building a Diversified Portfolio

The USD has weak or negative correlations to many prominent assets. Consequently, whether investors have exposure to U.S. equities or fixed income, European equities, or commodities, adding the USD could improve overall portfolio diversification.

OANDA can help you trade smarter with a wide range of currencies, including the USD.

Note: Past performance is not indicative of future results.