TOKYO, Nov 18 (News On Japan) –

Nissan has announced a major restructuring plan involving the elimination of 9,000 jobs worldwide, triggered by worsening business performance.

This move has drawn significant attention from activist investors, often referred to as “shareholder activists,” signaling increased pressure on the automaker to overhaul its operations. Additionally, the broader Japanese automotive industry is bracing for potential shifts under the new Trump administration, with implications for trade policies that may favor Toyota while disadvantaging Honda.

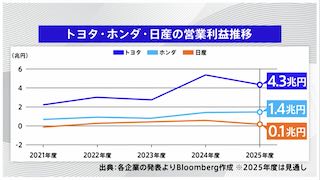

Nissan’s announcement on November 7th highlighted plans to cut global production capacity by 20%, a response to declining profitability in key markets like the United States and China. The company cited increased promotional costs in U.S. dealerships and intensified competition in China as key challenges. Nissan also revised its global sales forecast downward by 250,000 units, now projecting a total of 3.4 million vehicles for the fiscal year. Its operating profit forecast was drastically reduced from 500 billion yen to 150 billion yen, falling far below market expectations.

On November 12th, Bloomberg reported that a fund linked to the former Murakami Fund had acquired a 2.5% stake in Nissan, igniting speculation about a potential push for changes in corporate governance. The focus is on Nissan’s subsidiary, Nissan Shatai, which some argue should be fully integrated into the parent company.

Industry analysts suggest that Nissan’s struggles are rooted in slow adaptation to market trends, particularly in electric vehicles (EVs) and hybrids. While competitors like Toyota and Honda have capitalized on these segments, Nissan has lagged in introducing competitive models, with some new technologies still years away from market readiness.

Looking ahead, challenges remain significant for Nissan, with the specter of trade policy changes under Trump’s administration adding to the uncertainty. While companies with established production bases in North America, like Toyota, may find advantages, those relying heavily on imports from Mexico or China could face higher costs.

As activist investors push for restructuring, Nissan faces mounting pressure to revitalize its operations amidst a rapidly changing global automotive landscape.

Source: TBS