Expert on retirement savings Indira Venkat serves as the Senior Vice President of Research at AARP, she joins LiveNOW from FOX to discuss a recent survey that found more than 20% of adults ages 50 and older have no retirement savings. Venkat explains how Americans are worried about covering basic expenses. The Internal Revenue Service (IRS) […]

Source: The College Investor The HSA Contribution Limit for 2024 is $4,150 for self-only, and $8,300 for families. But that’s not the only HSA rules you need to know. Health Savings Accounts (HSAs) are tax-advantaged individual savings accounts designed specifically to pay for the medical expenses of individuals who are enrolled in high-deductible health plans […]

Increasing the catch up contribution limits is very helpful for people who took longer than others to get their feet under them or established in their careers. I understand the compounding impacts to saving earlier in your career has, but when you turn 50, I feel that we should be reconsidering this threshold annually and […]

Source: The College Investor The Internal Revenue Service (IRS) has increased the tax brackets for 2025 The Standard Deduction is also going to be higher for 2025 Single taxpayers must earn over $626,351 to be in the highest 37% tax rate The IRS announced its changes for the 2025 tax filing season, which included increases to […]

Source: The College Investor The IRS Direct File program is a free option from the IRS to file your taxes. This will be the second year of the program, and it’s expanded to more states. In the United States, you can hire a tax professional to file your taxes, or you can use tax software […]

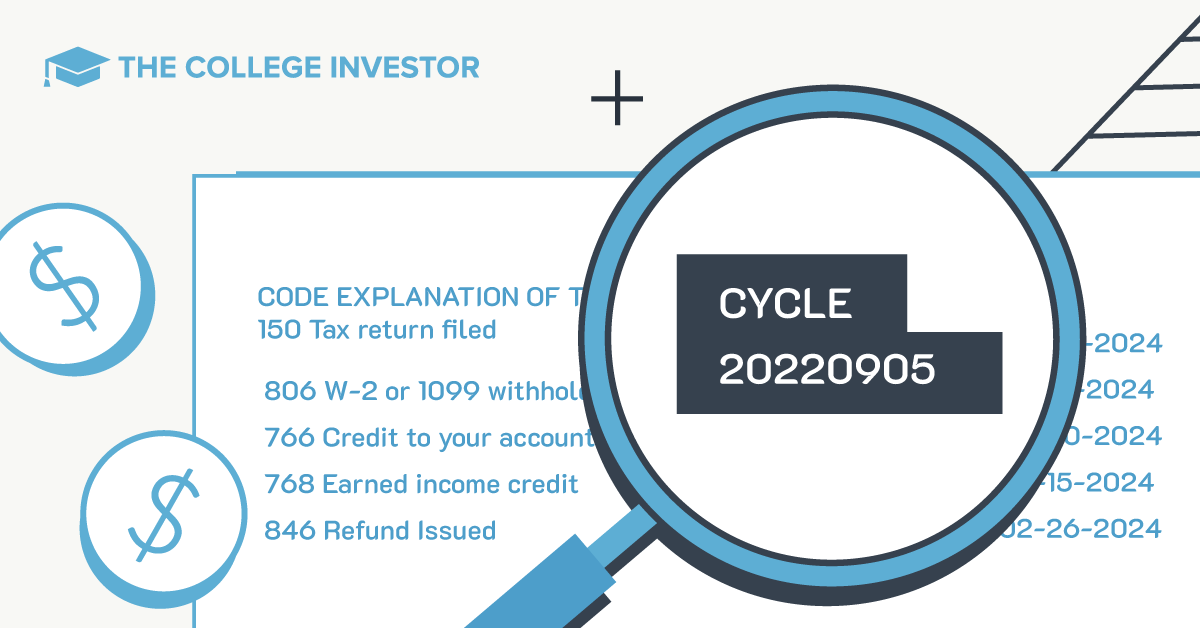

Source: The College Investor An IRS cycle code is an 8-digit code on your IRS tax transcript that indicates the day your return was posted to the IRS Master File. Understanding this number can help you determine when your tax refund is likely to be processed and deposited. It can also help you figure out […]