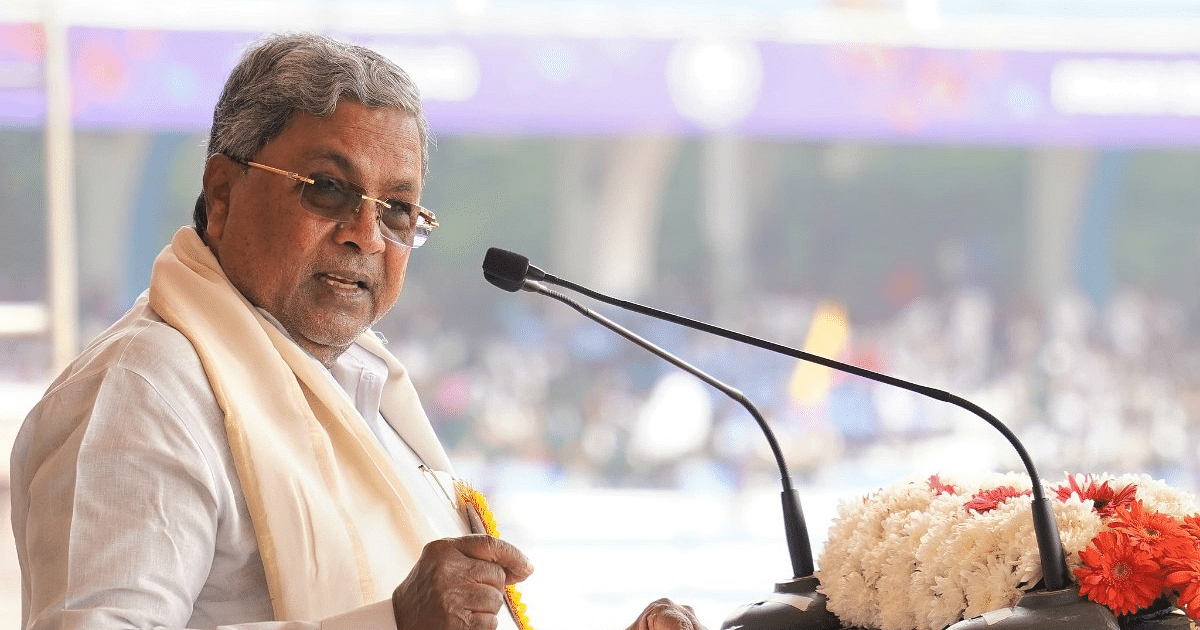

Reemphasising the need for fair tax distribution, Karnataka Chief Minister Siddaramaiah noted that the state receives only about Rs 55,000-60,000 crore from the Centre after contributing over Rs 4 lakh crore in taxes. “We are only getting 14 paise to 15 paise of every one rupee of our contribution. No one should milk a milch […]

The IRS has announced new income limits for its seven tax brackets for 2025, with income thresholds increased by about 2.7% to adjust for inflation. This follows a 5.4% increase in 2024 and a historically large 7% bump in 2023. Reaching a top one percent income is becoming more challenging given the threshold keeps increasing […]

Apple reports better-than-anticipated Q4 revenue, earnings hurt by EU tax payment Yahoo Finance Apple sales rise 6%, company seeing early iPhone 16 demand CNBC Apple’s Quarterly Profit Down Because of Tax Payment in Europe The New York Times Apple to report Q4 earnings as Wall Street looks for signs of Apple Intelligence payoff Yahoo Finance iPhone sales are booming […]

November 1, 2024 18:21 | News Mining companies are touting their contribution to the Australian public purse, having topped the corporate tax table again. Corporate Australia paid almost $100 billion in income tax in 2022/23, an increase of nearly 17 per cent on the previous year, the Australian Taxation Office revealed in its 10th annual […]

• Presidency clarifies derivation-based VAT model amid northern govs’ opposition• Reps to probe N121.67tr federal, state loans, borrowing since 1999• Okunlola warns of rising debt, calls for oversight on loan utilisation Amid controversy over President Bola Tinubu’s tax reform bills submitted to the National Assembly, the Senate and House of Representatives unexpectedly adjourned plenary sessions […]

News Corp, Transurban and Santos are yet again Australia’s top tax dodgers, the latest tax data shows, while the big miners paid full freight. A broken piggy bank (Image: Adobe) Serial tax dodgers News Corp, Santos, Qantas and Transurban once again failed to pay any income tax in Australia in 2022-23, the latest Australian Tax […]

ATO reveals almost a third of companies paid no income tax in 2022-23 Elias Visontay Australia’s largest corporations paid almost $100bn in income tax in a year, fresh statistics published by the government reveal. The latest data, released by the Australian Taxation Office (ATO) on Friday, covers the 2022-23 financial year, and reveals the office […]

Apple on Thursday announced its fourth quarter 2024 earnings, posting revenue of $94.9 billion for the quarter, a 6 percent increase year over year, and a record for the quarter. Quarterly earnings per diluted share are $0.97. Diluted earnings per share was $1.64, up 12 percent year over year. The company reported $14.7 billion in profit. Apple […]

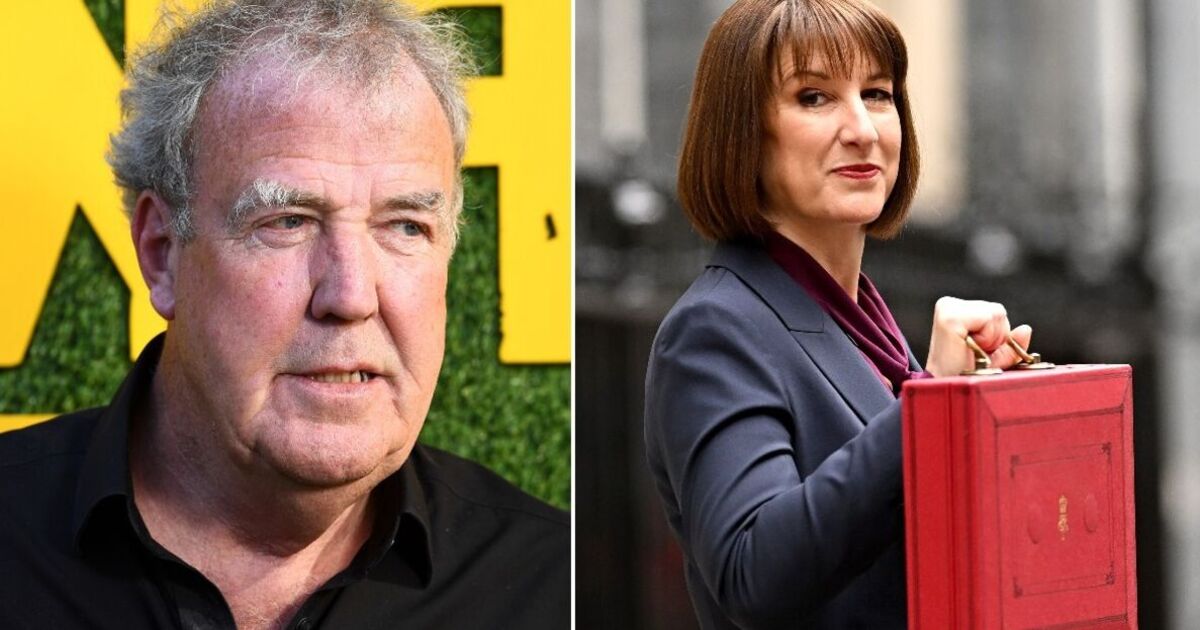

Jeremy Clarkson warned farmers had been “shafted” in Reeves’s historic Budget (Image: Getty) Labour’s “cruel farm tax” will have a “disastrous” impact on thousands of family-run rural businesses, the Chancellor has been warned. Rachel Reeves is being urged to reverse her decision to scrap a vital tax lifeline for family-run farms after it was roundly […]

The Autumn Budget has extended tax incentives for electric company cars until at least April 2030 but put significant rises on the horizon for plug-in hybrids and double-cab pick-up trucks. Company car tax has incentivised low-CO2 vehicles since 2002. The benefit of having a car for personal use has what’s called a taxable value – a percentage […]